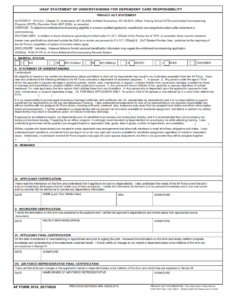

AF Form 3010 – Usaf Statement Of Understanding For Dependent Care Responsibilities

FINDERDOC.COM – AF Form 3010 – Usaf Statement Of Understanding For Dependent Care Responsibilities – As a member of the United States Air Force, serving our country often means being away from family and loved ones for extended periods. For this reason, the Air Force recognizes that dependents require care and support when service members … Read more