The Internal Revenue Service (IRS) W2 form is an important document for both employers and employees. It serves as a record of wages earned by the employee during the year, as well as taxes withheld from those earnings. This article will explain what this important document is, what kind of information it has, how to get it, and how to use it when filing tax returns. Whether you’re an employer or an employee, you need to understand this form to do your taxes right and on time.

What is a W2 Form 2022?

A W2 form is an official document that employers use to report their employees’ wages and salary information to the Internal Revenue Service (IRS). The form has details like total earnings, federal and state taxes withheld, Social Security and Medicare tax contributions, and other important information. Employees receive their copy of the W2 form each year in January or early February.

The W2 form is essential for filing taxes accurately. Employers are required by law to provide a W2 form to each employee who earned more than $600 in wages during the previous year. Employees use this document when filing their income tax returns with the IRS. It helps them determine how much they owe in taxes or how much they can expect in a refund.

If you have never received a W2 form from your employer or if there are errors in your copy, contact your employer immediately. You may also need to speak with an accountant or tax professional for guidance on resolving any issues with your W2 forms before filing your income tax return with the IRS.

Who Needs W2 Form 2022?

The W2 form is a mandatory document that every employer must issue to their employees at the end of each year. The form contains important details regarding an employee’s annual income, taxes paid, and other relevant information. In general, any individual who has received payment from an employer in exchange for services rendered should expect to receive a W2 form.

Moreover, the IRS requires employers to provide W2 forms to all full-time employees as well as part-time employees who have worked more than 80 hours during the calendar year. Even if someone worked for just one day or one hour during the year, they still need a W2 form. This means that employers must also give this document to seasonal workers, freelancers, and independent contractors who are paid more than $600.

Individuals who have changed jobs during the year may receive multiple W2 forms from different employers depending on how long they had been working with each company. Overall, it is important for both employers and employees to be aware of when and how these forms should be filled out and distributed in order to avoid any penalties or issues with tax filings later on.

Benefits of Filing W2 Form 2022

Filing the W2 form benefits both employers and employees in several ways. For employers, it ensures that they comply with federal tax regulations and avoid penalties for late or incorrect filing. It also helps them keep track of their employees’ income and tax withholdings, which can be useful in calculating payroll expenses and making important financial decisions.

For employees, filing the W2 form is an essential step in fulfilling their tax obligations. It provides a detailed record of their income for the year, including any taxes withheld from their paychecks. This information is necessary when preparing individual tax returns or applying for government benefits such as social security or Medicare.

Filing the W2 form is crucial for both employers and employees as it helps ensure compliance with federal tax regulations, provides valuable financial records, avoids penalties for late or incorrect filing, and streamlines tax preparation processes.

Common Errors to Avoid When Filing W2 Form 2022

One of the most common errors to avoid when filing a W2 form is incorrect information. Ensure that all details are accurate, including the employer’s name and address, employee’s social security number, salary and wages paid during the year, taxes withheld, and other relevant details. Any errors or inaccuracies in these details can lead to delays in processing your tax returns. Here are some common errors to avoid when filing a W2 form:

- Incorrect or missing Social Security numbers: Double-check that you have entered the correct Social Security number for both the employer and the employee. Any errors can cause problems when it comes time to file taxes.

- Incorrect or missing employer identification numbers: Employer identification numbers (EINs) are unique numbers assigned by the IRS to identify businesses. Ensure that the EIN listed on the W2 form matches the EIN that you have on file.

- Incorrect or missing employee information: Ensure that you have entered the correct name and address for the employee. Any misspellings or typos can cause problems down the line.

- Incorrect or missing tax withholding amounts: The W2 form includes information about the amount of taxes withheld from an employee’s paycheck. It’s important to make sure these amounts are accurate, as they can impact the employee’s tax return.

- Failing to file on time: The deadline for filing W2 forms is January 31st of the following year. If you fail to file on time, you may face penalties and interest charges.

- Failing to distribute copies to employees: Employers are required to provide employees with a copy of their W2 form. Make sure you distribute the forms on time, and that the information on the forms is accurate.

- Not keeping accurate records: It’s important to keep accurate records of employee wages, taxes withheld, and other information that may be needed when filing W2 forms. Make sure to keep these records up-to-date throughout the year.

- Using the wrong form: Make sure you are using the correct version of the W2 form. There are different versions for employees who work for the government or who receive non-wage income.

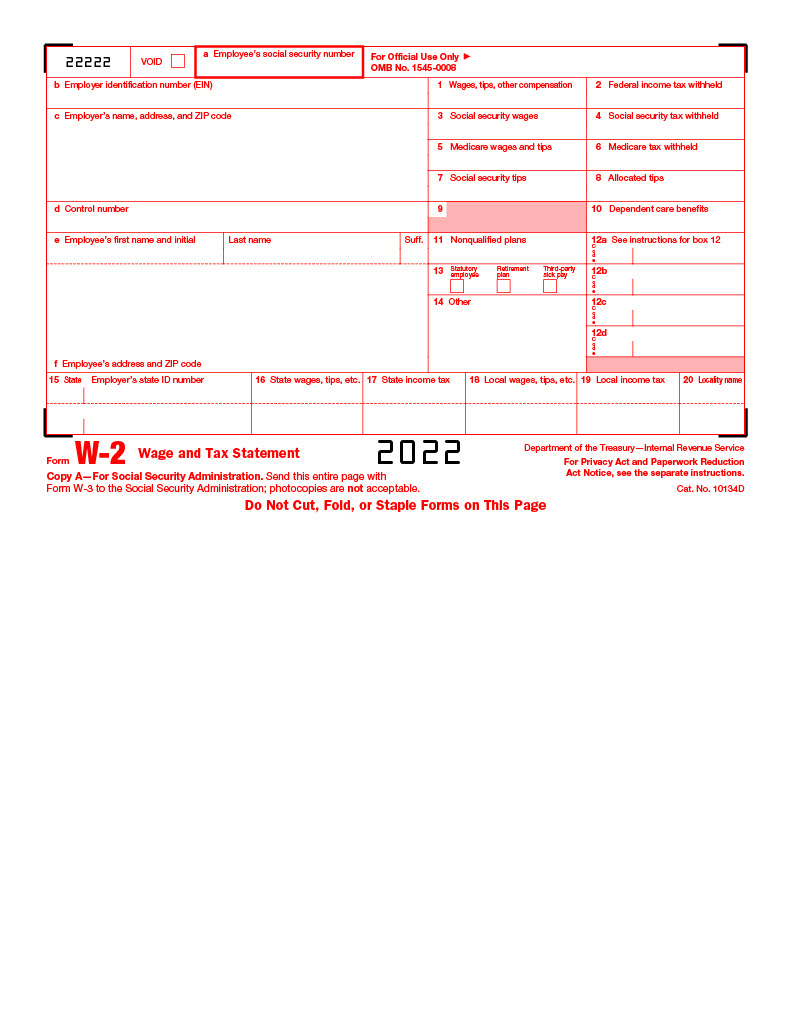

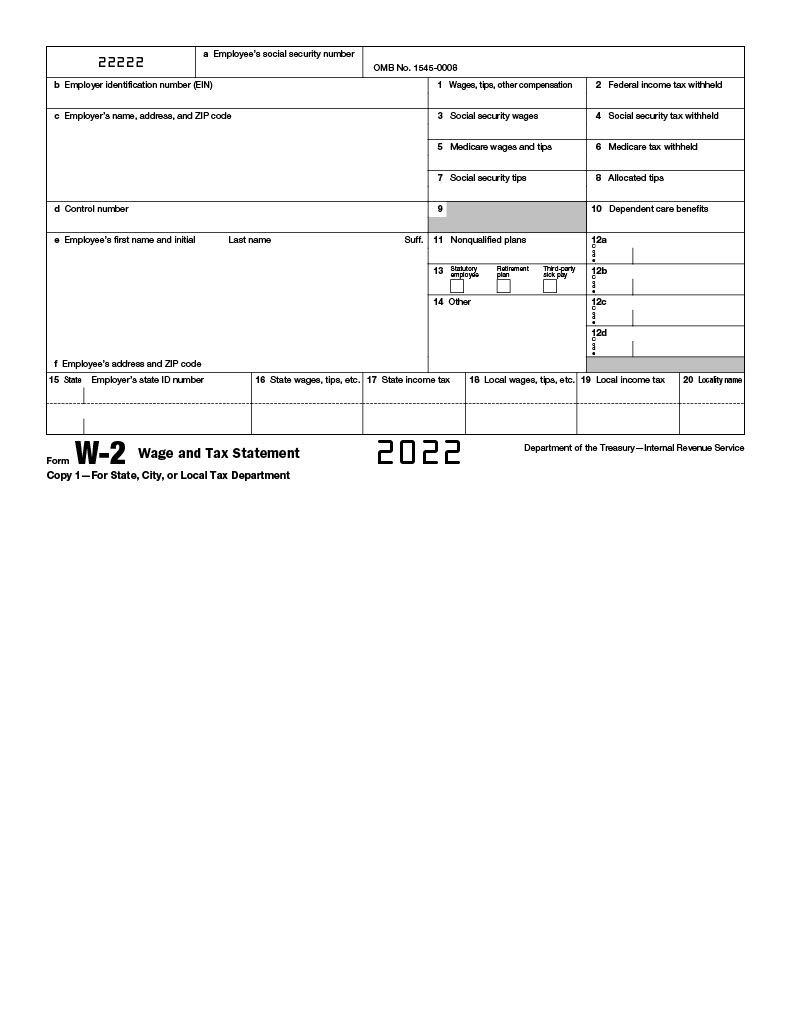

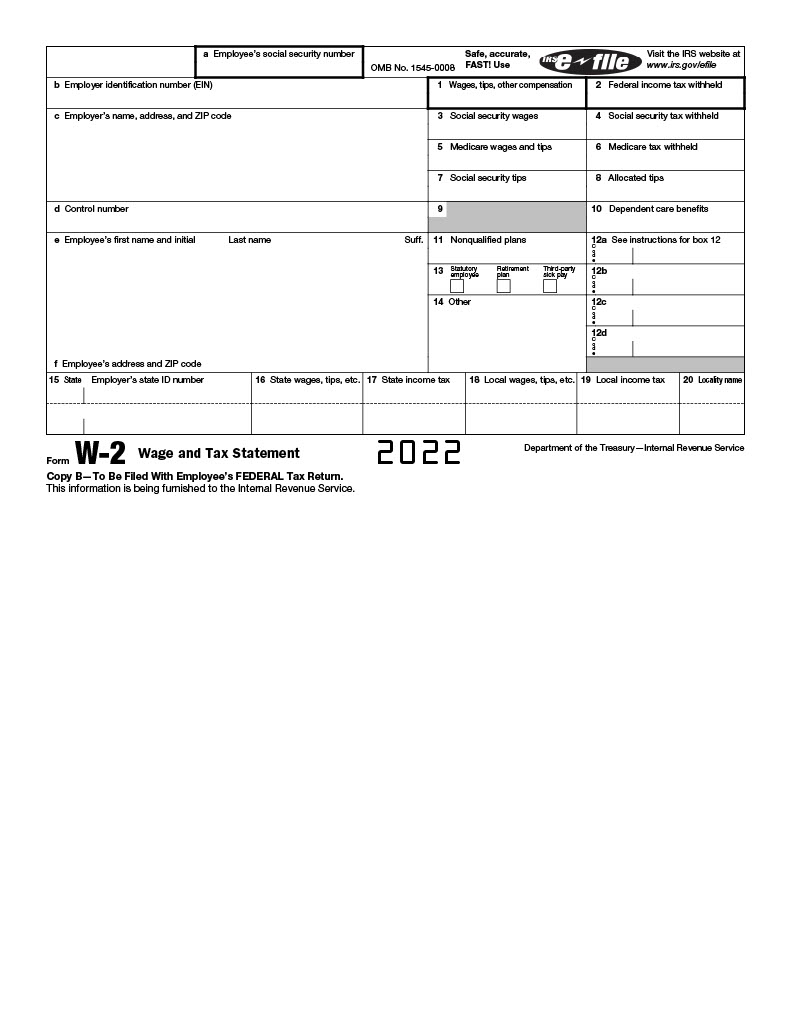

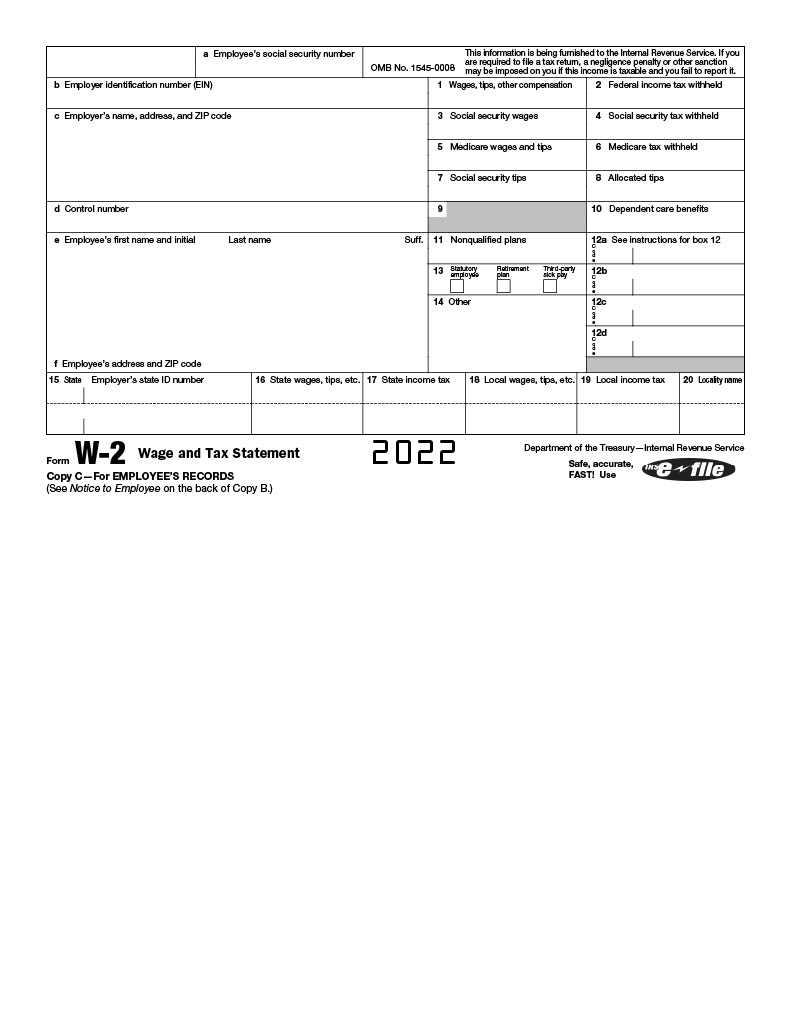

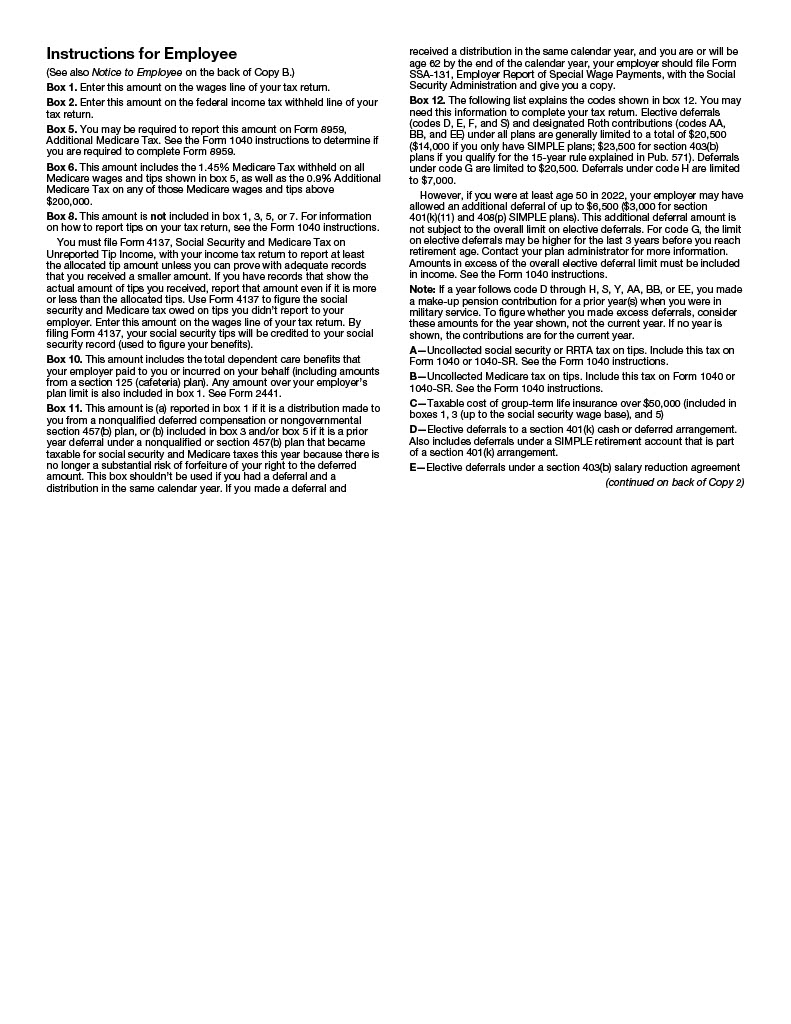

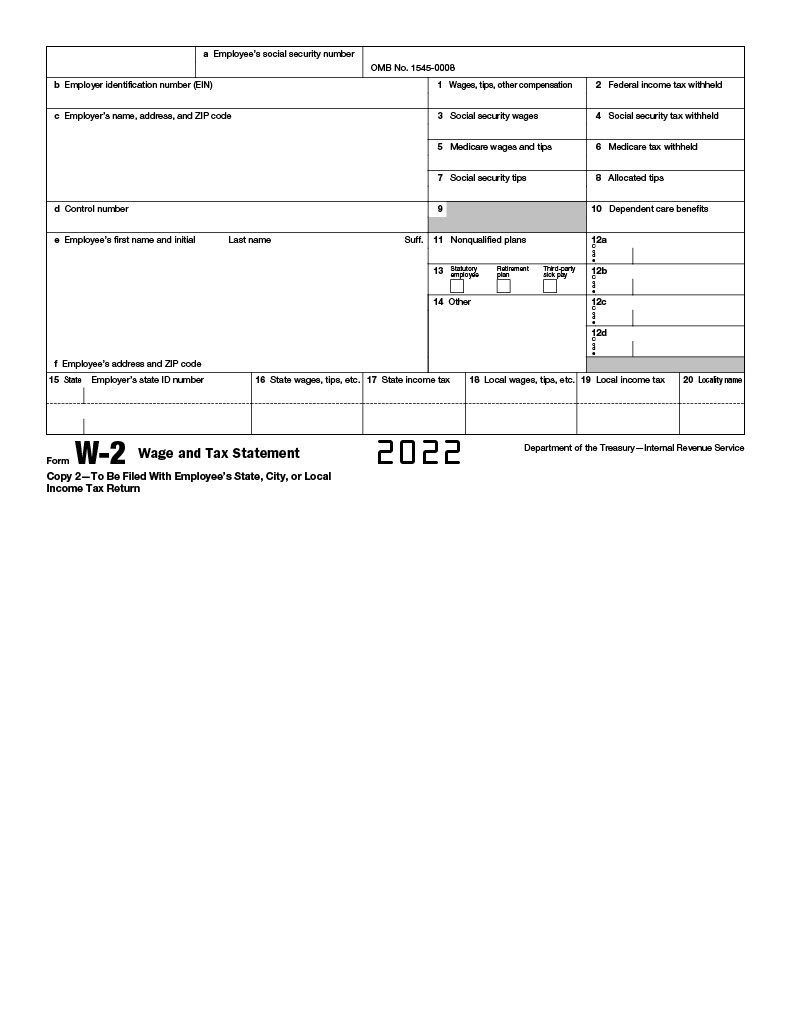

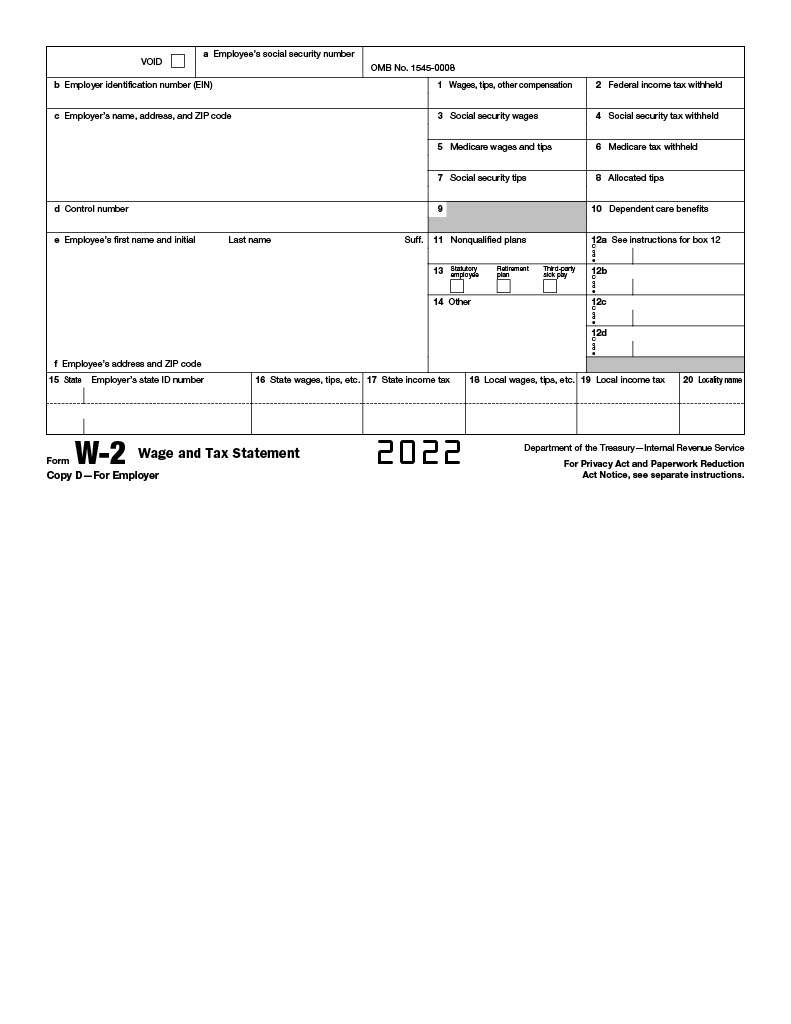

IRS W2 Form 2022 Samples (JPG Format)

IRS W2 Form 2022 Printable (PDF)

Print W2 Form 2022.