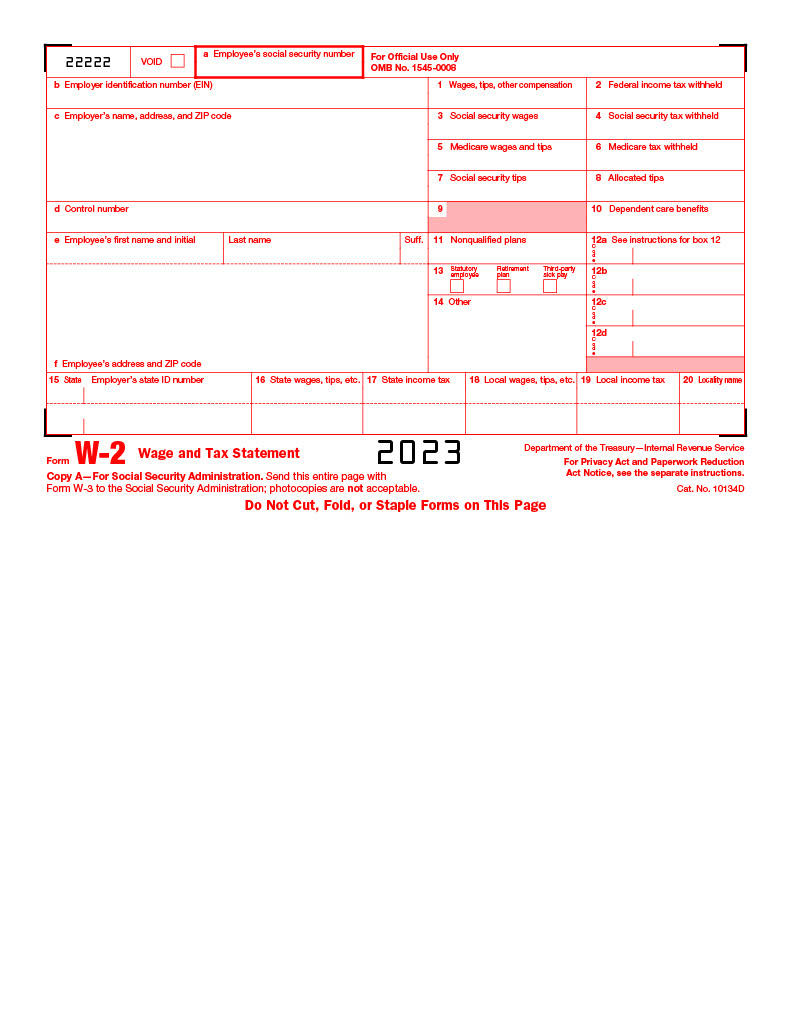

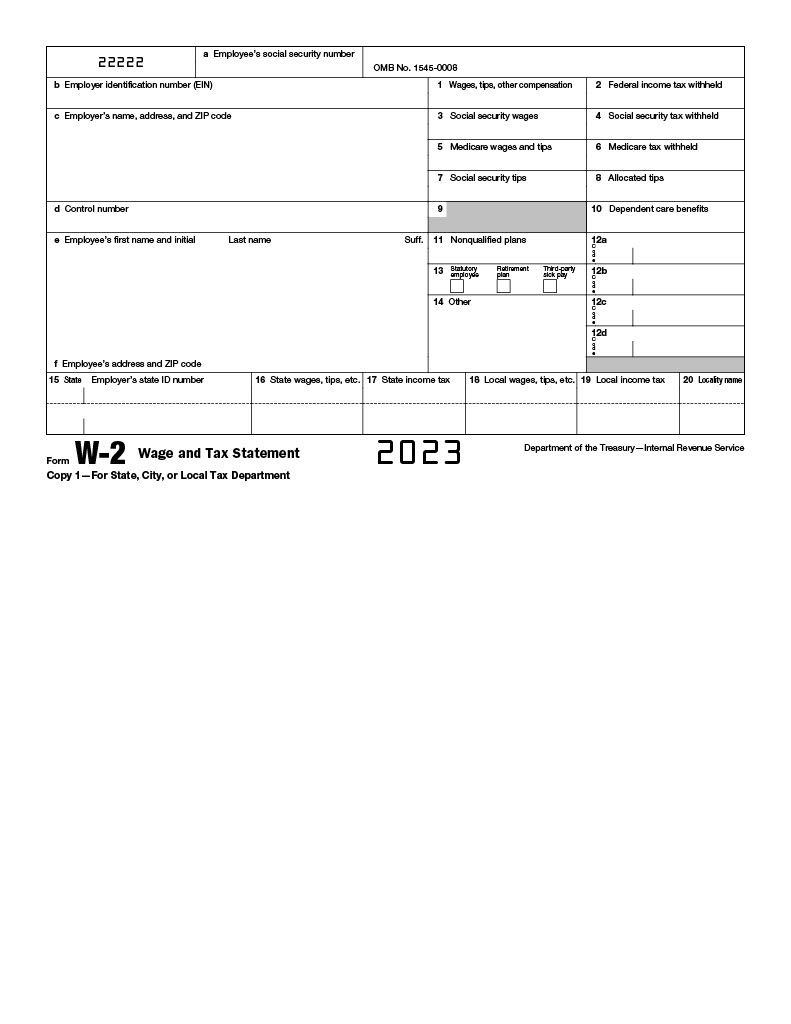

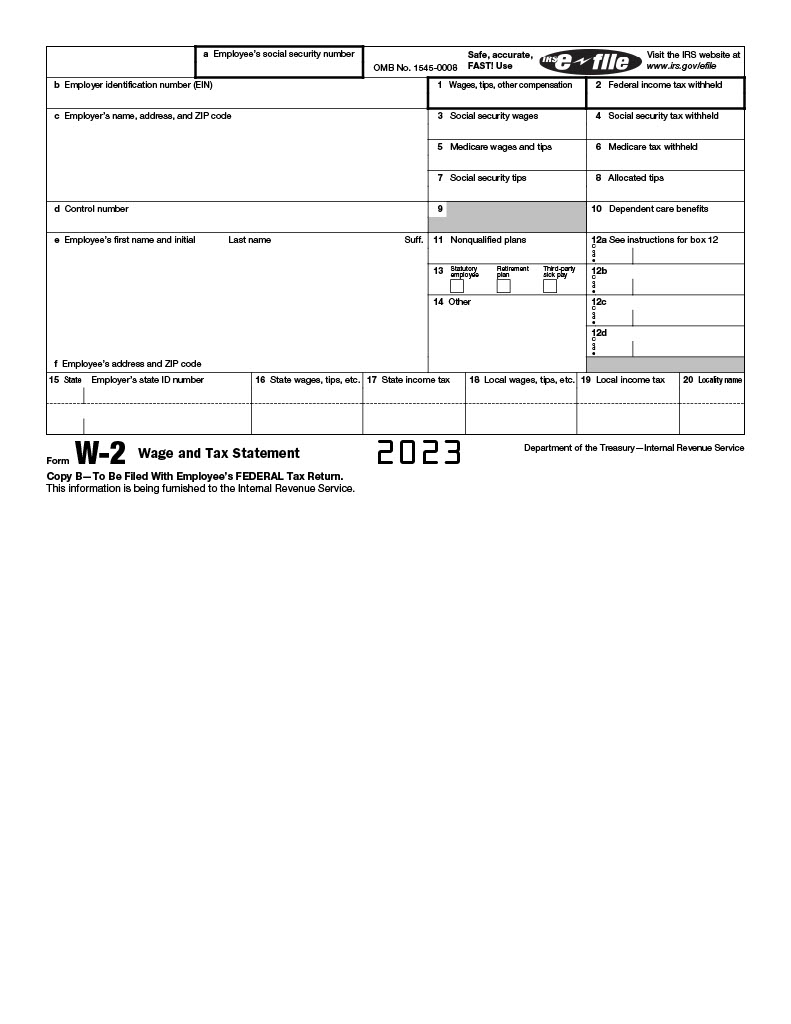

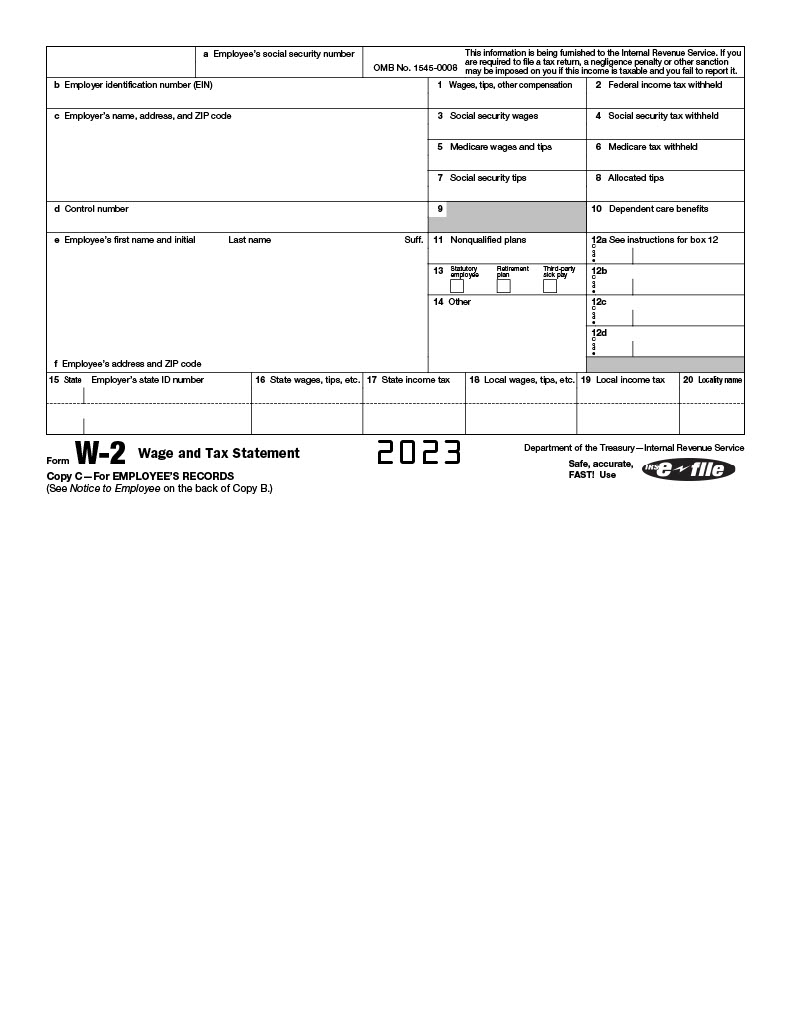

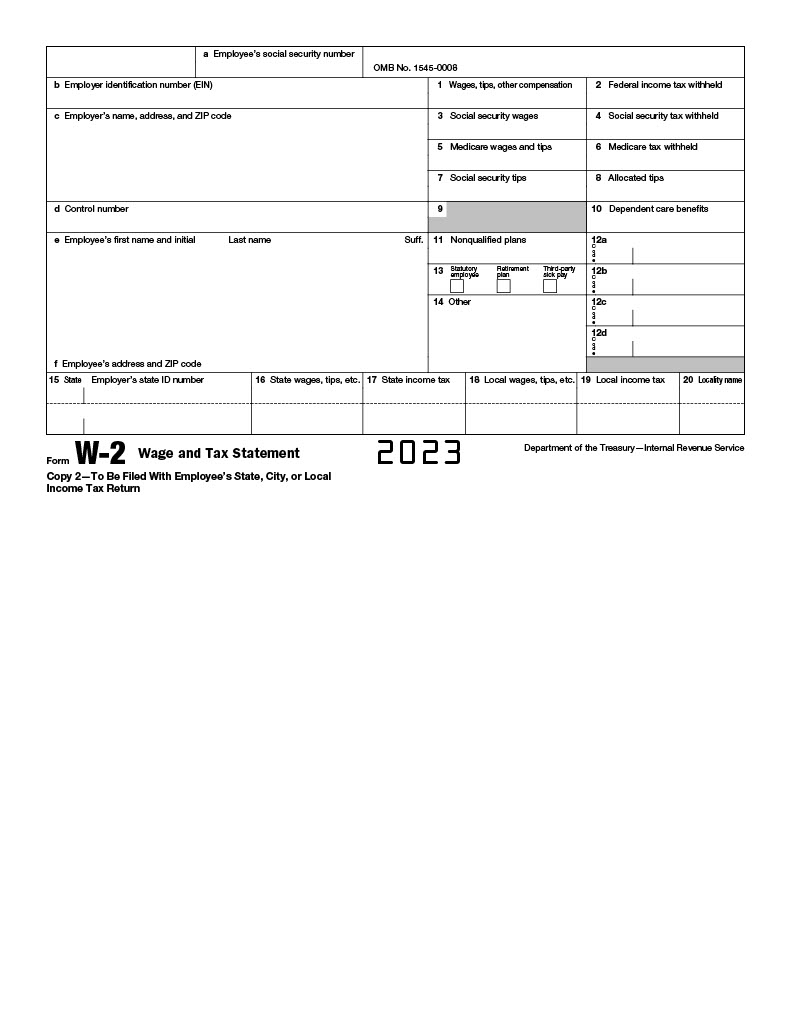

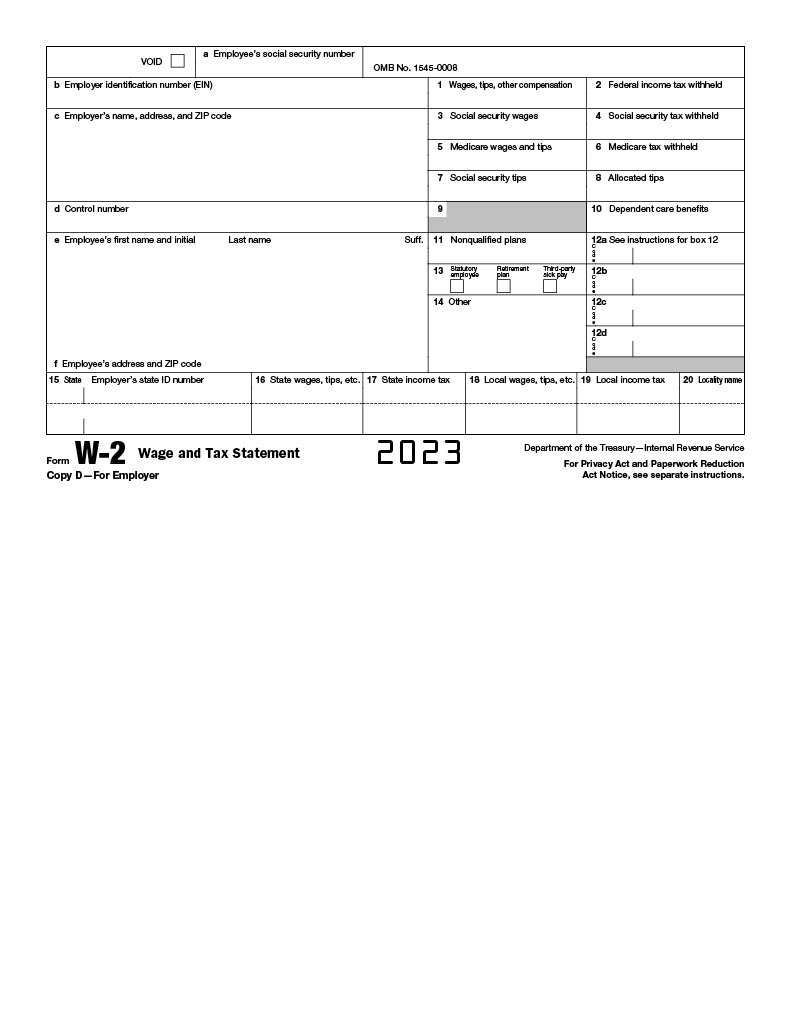

W2 Form 2023 Printable – The Internal Revenue Service (IRS) W2 form is one of the most important documents taxpayers need to file their taxes. It is used by employers to report an employee’s wages and salary information, as well as any other income earned during the tax year. Knowing how to complete and submit a W2 form is essential for anyone who wants to accurately and legally pay their taxes.

The IRS W2 form includes all the necessary details employers must provide in order for employees to accurately file their taxes. This includes an employee’s name, address, Social Security number, type of income received, amount of wages paid, the amount withheld for federal income tax, Medicare tax, and Social Security withholding. It also states whether an employer contributed money towards certain benefits such as health insurance or retirement plans on behalf of its employees.

What is IRS W2 Form?

IRS W2 Form is an important form that employers must provide to their employees and submit to the Internal Revenue Service (IRS) each year. It’s used to report an employee’s annual wages and taxes withheld from those wages, such as Social Security and Medicare taxes. The information provided on the form is essential for completing a federal or state tax return, as well as keeping track of earnings for retirement benefit calculations.

Employers must issue IRS W2 forms by January 31st of every year, either electronically or via mail. Employees should receive theirs shortly after the due date so they have time to accurately complete their tax returns before the April 15th deadline. Understanding all the components of a W2 Form helps ensure accurate filing and may make it easier to understand potential tax implications when making financial decisions throughout the year.

Is There a New IRS W2 Form for 2023?

The IRS W2 Form is one of the most important documents for employees and employers alike. It contains detailed information about an employee’s income, how much in taxes were withheld, and other relevant information required by the IRS. Every year, the form changes slightly to fit current tax laws and regulations. The question on everyone’s mind is whether or not there will be a new IRS W2 Form in 2023.

The answer is yes! The Internal Revenue Service has announced that it will be introducing its new W2 form 2023 to accommodate recent changes to tax law. The new form will include updated fields for employer-provided benefits such as health insurance premiums, commuter benefits, educational assistance, dependent care assistance plans, and much more. It also includes improved reporting requirements for wages paid over $600 during the calendar year to independent contractors.

Where Can I Get The Recent IRS W2 Form?

If you are an employer or employee, the Internal Revenue Service (IRS) requires that you submit a W2 form to report wages paid and taxes withheld. Working with the IRS can be confusing, so it is important to understand where and how to get the current W2 form.

The simplest way to obtain a copy of the most recent IRS W2 Form is through the IRS website. The website provides access to various forms and publications, including Instructions for Forms W-2 and W-3, which give employers guidelines on completing their forms properly. Additionally, employers can download a fillable version of these documents directly from the site. Employees who need copies of their own records should contact their employers directly for copies of these forms.

In addition to online resources, taxpayers can also find hard copies of these forms at local libraries or post offices.

W2 Form 2023 Printable – IRS Form W-2 Fillable PDF

| Form Number | W2 Form |

| Form Title | Wage and Tax Statement |

| File Size | 1 MB |

| Form by | IRS Forms |

W2 Form 2023 Printable Examples