If you are a new employee or have experienced a significant life event like a marriage, the birth of a child, or a change in your financial situation, you might need to fill out a new W4 Form. This document tells your employer how much money to withhold from your paycheck for federal taxes. But the process can be daunting if you don’t understand the details.

In this comprehensive guide, we’ll cover everything you need to know about the W4 Form, from the basics to the nitty-gritty details of filling it out.

Understanding the Basics of W4 Form 2023

Definition and Purpose of W4 Form 2023

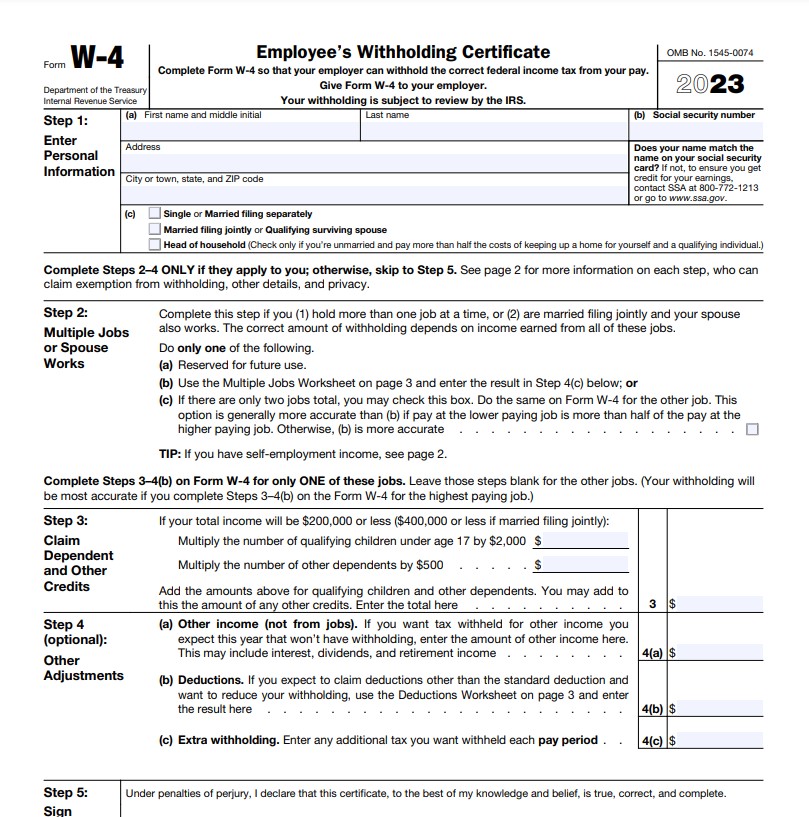

The W4 Form, or Employee’s Withholding Certificate, is a document that employees fill out to indicate the amount of federal income tax that should be withheld from their paychecks. The form serves two main purposes:

- It tells your employer how much money to withhold from your paycheck for federal taxes.

- It helps you avoid owing taxes or receiving a large refund when you file your tax return.

Who Needs to Fill Out a W4 Form 2023?

Every new employee needs to fill out a W4 Form. However, you might need to fill out a new form if you experience a significant life event or want to adjust your tax withholding.

The Difference Between W4 and W2 Form

The W4 Form is not the same as the W2 Form. While the W4 Form tells your employer how much money to withhold from your paycheck for federal taxes, the W2 Form shows the amount of money you earned and the taxes withheld during the year. You’ll receive a W2 Form from your employer in January or February each year, and you’ll use it to file your tax return.

Key Components of W4 Form 2023

1. Personal Information Section

The first section of the W4 Form asks for your personal information, including your name, address, and Social Security number.

2. Filing Status Section

The second section asks for your filing status, determining how much money will be withheld from your paycheck. You can choose from the following options:

- Single or Married Filing Separately: This option is for people who are unmarried or who are married but want to file separately from their spouse.

- Married Filing Jointly: This option is for couples who want to file a joint tax return.

- Head of Household: This option is for unmarried people who support at least one dependent.

3. Multiple Jobs or Spouse Works Section

The third section is for people with more than one job or who is married and have a spouse who works. You can use the worksheets provided to calculate the appropriate amount of tax to withhold.

4. Dependents Section

The fourth section asks for information about your dependents, including their names and Social Security numbers. You can claim an allowance for each dependent, reducing the tax withheld from your paycheck.

5. Other Adjustments Section

The fifth section is for other adjustments, such as extra withholding, additional income, or deductions. You can use the worksheets provided to calculate the appropriate amount of tax to withhold.

Filling Out Your W4 Form 2023

Tips for Completing W4 Form Accurately

When filling out your W4 Form, make sure to:

- Use the correct filing status.

- Claim the correct number of allowances.

- Complete the form in its entirety.

- Use the worksheets provided to calculate the appropriate amount of tax to withhold.

Understanding Allowances and Exemptions

You claim an allowance on your W4 Form for yourself, your spouse, and your dependents. The more allowances you claim, the less money will be withheld from your paycheck for federal taxes.

How to Calculate the Right Number of Allowances for Your Situation

You can use the IRS withholding calculator or the worksheets provided on the W4 Form to calculate the right number of allowances for your situation. These tools will help you determine the appropriate allowances based on your filing status, number of dependents, and other factors.

Common Mistakes to Avoid

- Incorrect Personal Information: Ensure you provide accurate personal information on your W4 Form, including your name, address, and Social Security number.

- Choosing the Wrong Filing Status: Choosing the wrong filing status can result in too much or too little tax being withheld from your paycheck. Make sure to choose the appropriate filing status based on your situation.

- Not Updating Your W4 Form Regularly: If your financial situation changes, you might need to update your W4 Form to reflect the new information. Make sure to submit a new form to your employer if necessary.

- Over- or Underestimating Allowances: If you claim too many allowances, you might not have enough money withheld from your paycheck for federal taxes. You might have too much money withheld if you claim too few allowances. Use the IRS withholding calculator or the worksheets on the W4 Form to calculate the appropriate allowances.

How W4 Form Affects Your Paycheck and Taxes

- Understanding Withholding Taxes: Withholding taxes is the amount your employer withholds from your paycheck for federal and state taxes.

- The Relationship Between W4 Form 2023 and Paycheck: The information you provide on your W4 Form determines how much money will be withheld from your paycheck for federal taxes.

- The Impact of the W4 Form on Your Tax Return: The amount of money withheld from your paycheck for federal taxes will impact the amount you owe or receive as a refund when you file your tax return.

W4 Form 2023 Printable

Print Now: W4 Form 2023 Printable

Common Questions and Answers About W4 Form

What is the New Form W-4?

The new Form W-4 is an updated version of the W4 Form released in 2020. It is designed to be more accurate and easier to use.

How Do You Fill Out a W-4 Form?

To fill out a W4 Form, you’ll need to provide accurate personal information, choose the appropriate filing status, claim the correct number of allowances, and provide any other necessary information.

What is the Purpose of a Form W-4?

A Form W-4 tells your employer how much money to withhold from your paycheck for federal taxes.

Do I Claim 0 or 1 on My W4?

The number of allowances you claim on your W4 Form will depend on your situation. The IRS provides worksheets and a withholding calculator to help you determine the appropriate number of allowances.

What is the Difference Between a W-2 and W4 Form?

The W4 Form tells your employer how much money to withhold from your paycheck for federal taxes, while the W2 Form shows the amount you earned and the taxes withheld during the year.

Do I Need Both W-2 and W4?

Yes, you will need both forms. The W4 Form tells your employer how much money to withhold from your paycheck for federal taxes, while the W2 Form shows the amount you earned and the taxes withheld during the year.

Why Use W4 Instead of W-2?

You cannot use the W2 Form instead of the W4 Form. The W4 Form is required by law for new employees and for those who need to update their withholding information.

Should I Claim 2 or 0 on My W4?

The number of allowances you claim on your W4 Form will depend on your situation. If you’re unsure how many allowances to claim, you can use the IRS withholding calculator or the worksheets provided on the W4 Form to help you determine the appropriate number.

How Do I Fill Out a W4 for Dummies?

Filling out a W4 Form can be confusing, but resources are available to help. You can use the IRS withholding calculator or the worksheets provided on the W4 Form to help you determine the appropriate amount of tax to withhold.

What are the Advantages of W4?

The advantages of the W4 Form include:

- The ability to ensure that the right amount of money is withheld from your paycheck for federal taxes.

- The ability to avoid owing taxes or receiving a large refund when you file your tax return.

How Do I Know How Much to Withhold on My W4?

You can use the IRS withholding calculator or the worksheets provided on the W4 Form to help you determine the appropriate amount of tax to withhold based on your filing status, number of dependents, and other factors.