FINDERDOC.COM – I-129CWR Form – Semiannual Report for CW-1 Employers – The CW-1 program allows U.S. employers to hire foreign nationals as nonimmigrant workers in certain circumstances when there is a temporary shortage of domestic workers. Employers who participate in the CW-1 program are required to submit a semiannual report, Form I-129CWR, to notify the U.S. government of their compliance with the program requirements. This article will provide an overview of the I-129CWR form and explain how employers can properly complete and submit it on time.

Download I-129CWR Form – Semiannual Report for CW-1 Employers

| Form Number | I-129CWR Form |

| Form Title | Semiannual Report for CW-1 Employers |

| File Size | 530 KB |

| Form By | USCIS Forms |

What is an I-129CWR Form?

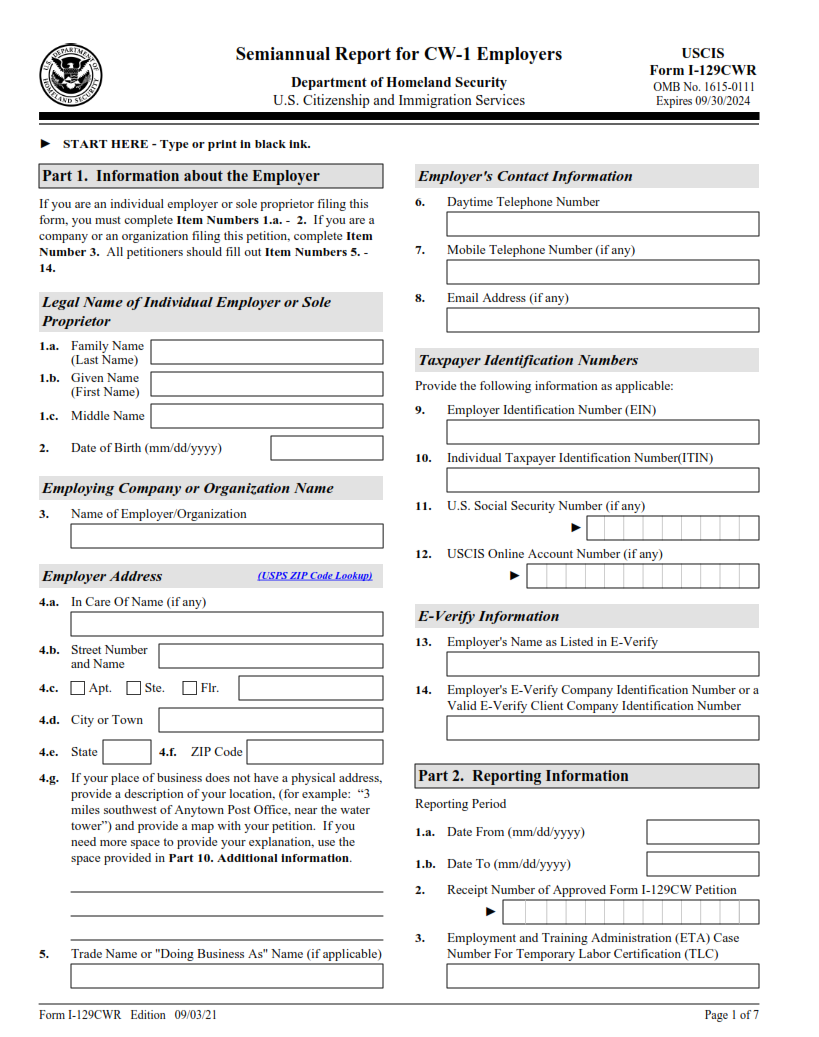

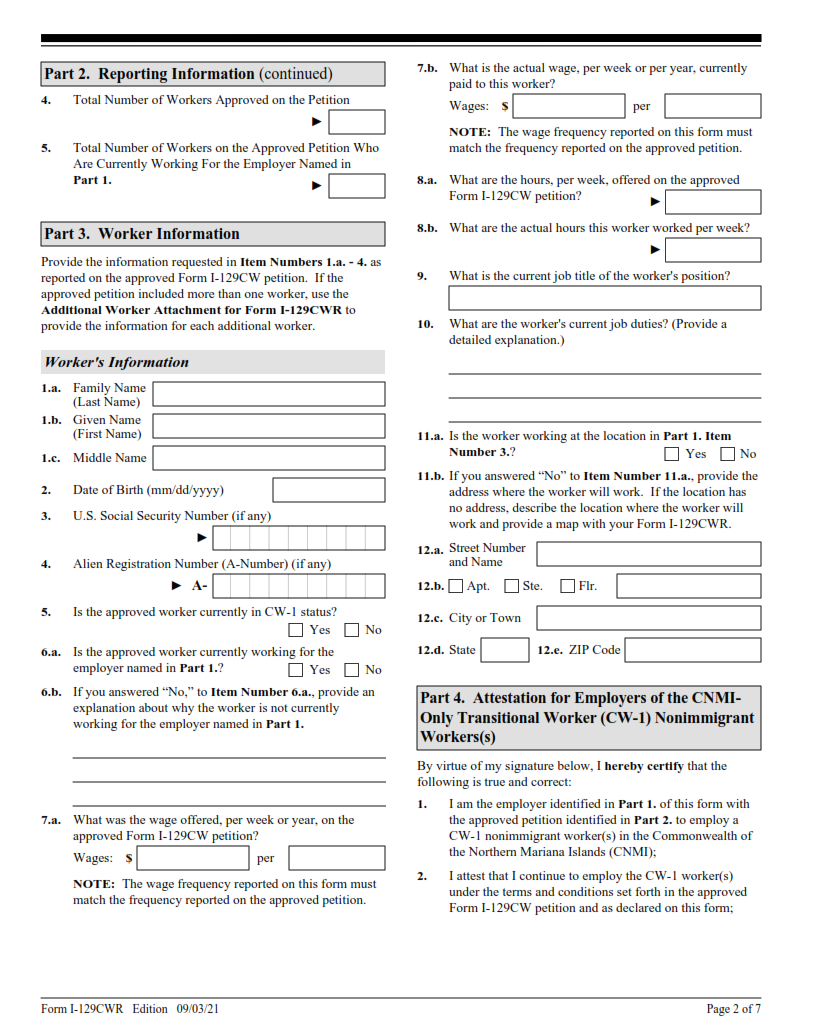

An I-129CWR form is a document used by United States employers to report information related to their CW-1 (CW stands for Commonwealth of the Northern Mariana Islands) employees. This form must be submitted semi-annually, and it contains important information about the number of employees, wages paid, and other relevant employment details. The purpose of this form is to ensure that employers are in compliance with all laws governing the hiring and employment of CW-1 workers.

The I-129CWR form includes questions regarding the employer’s business address, total number of CW-1 workers employed during the reporting period, wages paid to those individuals, any additional charges withheld from their paychecks such as taxes or insurance premiums, and more.

What is the Purpose of the I-129CWR Form?

The I-129CWR form, or Semiannual Report for CW-1 Employers, is an important document that employers of foreign workers must fill out. This form serves as a way to track the number of foreign workers employed in the United States and to ensure that these employers are compliant with federal immigration laws. Additionally, this form helps protect the rights of foreign workers by providing them access to resources such as health care and social security benefits.

The purpose of this form is twofold. First, it allows the government to keep accurate records regarding the number and type of foreign workers employed in the United States. Secondly, it serves as a way for employers to monitor their employees’ wages and working conditions in order to ensure they are compliant with labor laws. By submitting this report every six months, employers can be sure that their hiring practices meet all legal requirements.

Where Can I Find an I-129CWR Form?

The I-129CWR form is an important document for CW-1 Employers in the U.S. It enables them to keep track of the employees they have hired under the CW-1 visa program. In order to remain compliant with federal regulations, employers must submit this form semiannually.

The I-129CWR Form can be found on the official website of the U.S. Citizenship and Immigration Services (USCIS). There, employers will find a link to download and print out a copy of this form in PDF format. Once printed, it should be completed and submitted along with any supporting documents within 30 days after filing the initial petition or granting an extension for existing employment petitions for their CW-1 employee(s).

I-129CWR Form – Semiannual Report for CW-1 Employers

The I-129CWR form is an important document for employers in the Commonwealth of the Northern Mariana Islands (CNMI) who wish to hire foreign workers under the CW-1 visa program. This form must be filed semiannually with U.S. Citizenship and Immigration Services (USCIS). The purpose of this form is to report on the employment status of all CW-1 employees, including wages paid, hours worked, and other pertinent information.

In addition to reporting details about employee wages and hours, employers must also provide a list of all CW-1 employees they have hired during that period as well as a description of their job duties and length of stay. Furthermore, employers must certify that they are abiding by all CNMI immigration laws related to hiring foreign workers under this visa program.

I-129CWR Form Example