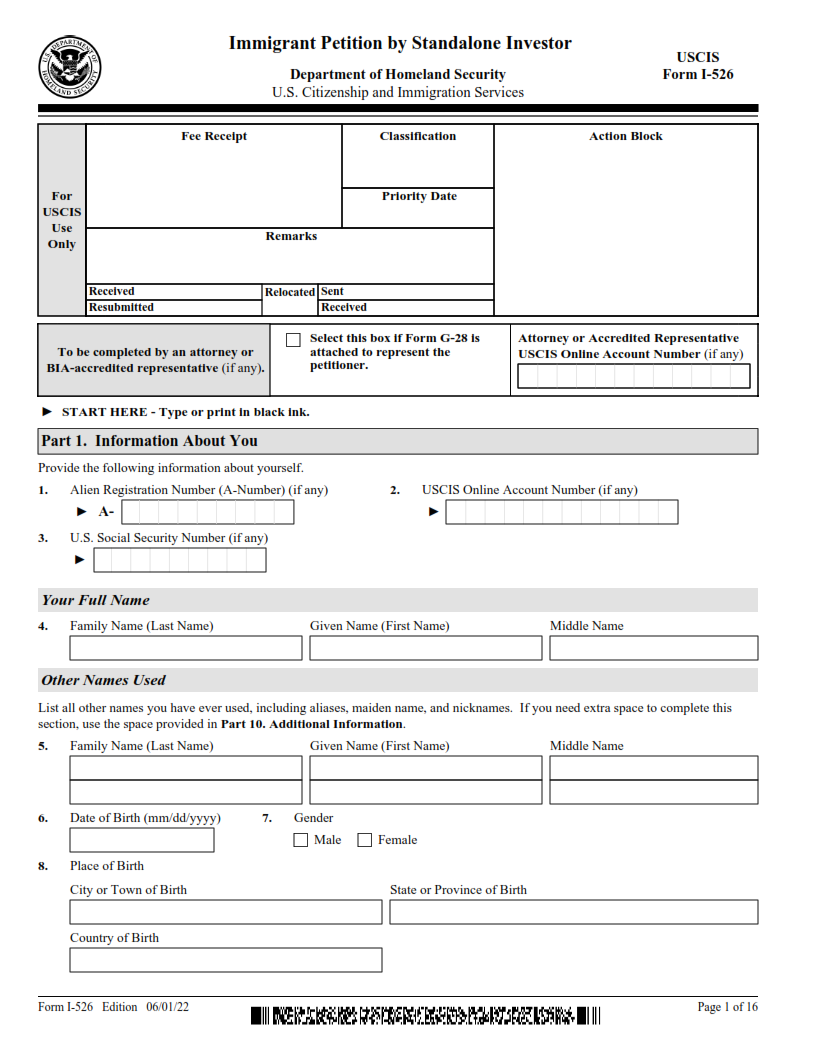

FINDERDOC.COM – I-526 Form – Immigrant Petition by Standalone Investor – The I-526 Form is a crucial document for any foreign national interested in becoming a permanent resident of the United States through investment. The form, also known as the Immigrant Petition by Standalone Investor, allows immigrants to petition for an immigrant visa based on their own investments and resources. This article will provide an overview of what the I-526 Form entails, as well as info about eligibility requirements and how to complete it correctly. Understanding what this form is and how to properly fill it out can greatly increase your chances of success when applying for a US visa through investment.

Download I-526 Form – Immigrant Petition by Standalone Investor

| Form Number | I-526 Form |

| Form Title | Immigrant Petition by Standalone Investor |

| File Size | 660 KB |

| Form By | USCIS Forms |

What is an I-526 Form?

The I-526 Form, or Immigrant Petition by Alien Investor, is a form that is used to apply for an EB-5 visa. It is the first step in the process of obtaining permanent residency in the United States through investment. To qualify for an EB-5 visa, applicants must invest at least $500,000 USD in a business located within either a Targeted Employment Area (TEA) or a Rural Area and have created at least 10 full-time jobs for US workers.

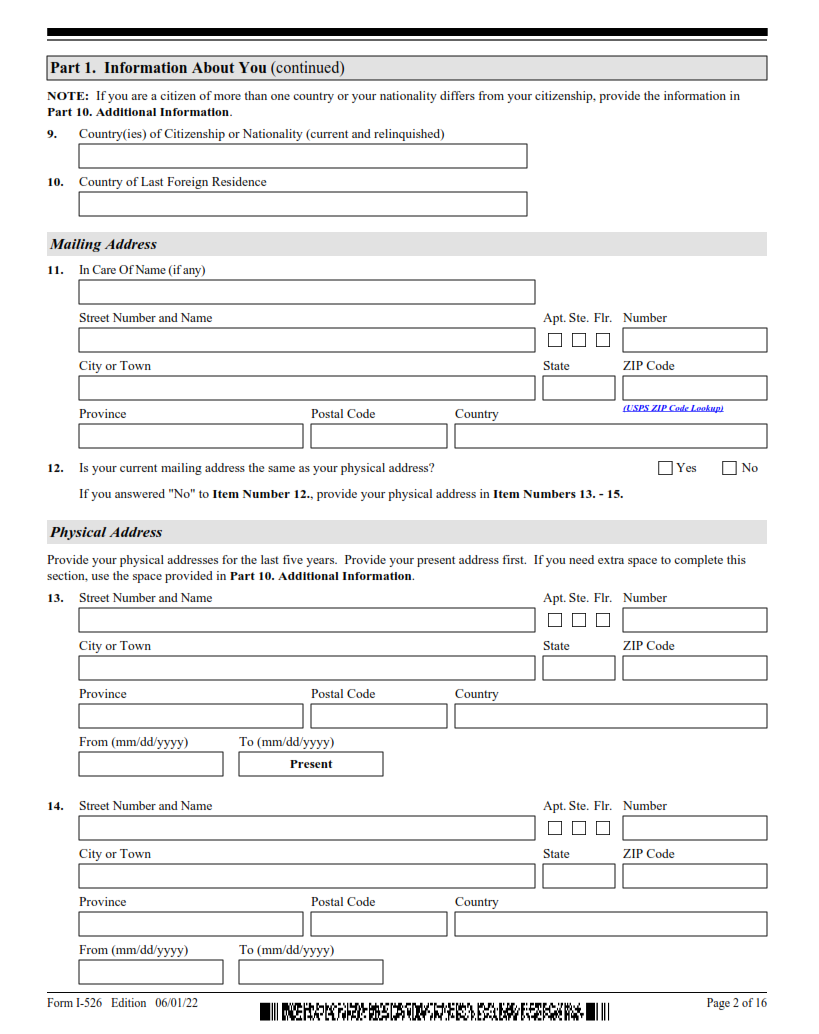

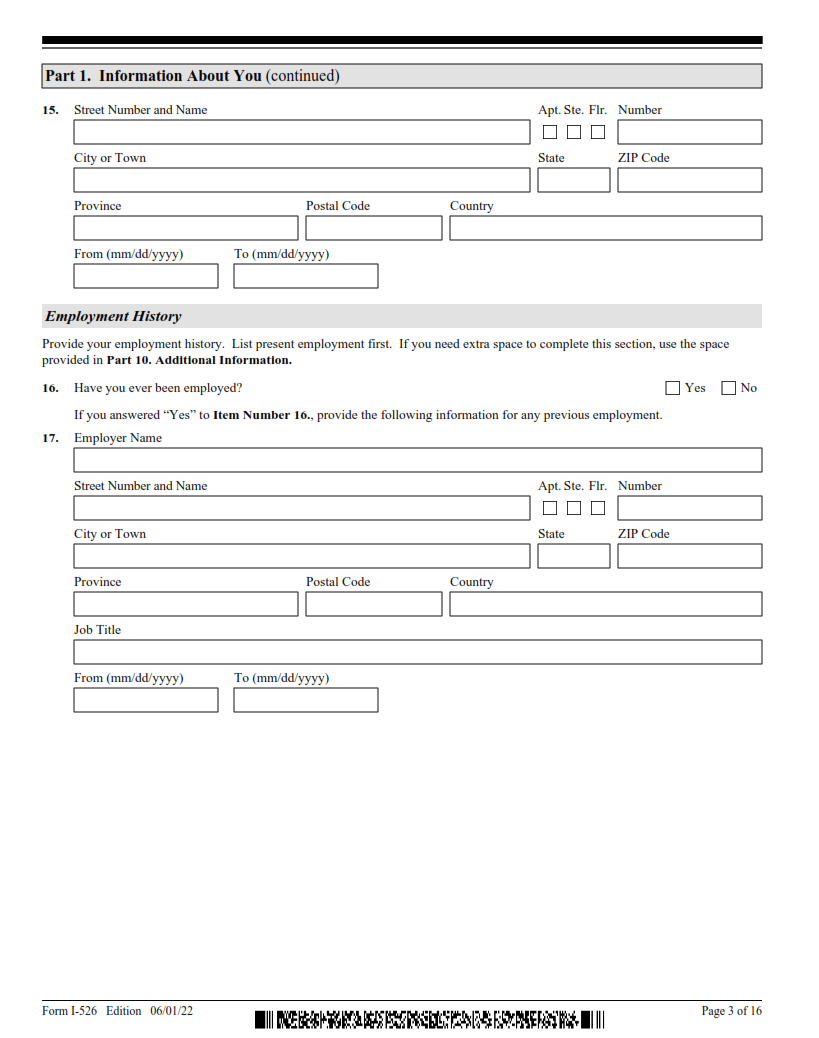

When filling out the I-526 Form, applicants will need to provide proof of their lawful source of funds and evidence that they meet all requirements to be considered an eligible investor. The form also requires information about the applicant’s business and financial investments as well as personal details such as name and address.

What is the Purpose of the I-526 Form?

The I-526 form, otherwise known as the Immigrant Petition by Standalone Investor, is used by foreign entrepreneurs and business owners to apply for permanent residency in the United States. The form must be filled out completely and accurately in order to be considered for approval.

When completing the I-526 form, applicants must provide detailed information about their business venture or investment proposal in the U.S., including but not limited to financial statements, evidence of legal rights and title documents regarding any assets owned in America. Additionally, applicants must demonstrate that they have sufficient funds available to cover all proposed investments. Finally, this form also requires supporting evidence regarding job creation for U.S citizens or lawful permanent residents through the proposed investment project.

Where Can I Find an I-526 Form?

The I-526 form, also known as the Immigrant Petition by Standalone Investor, is an important part of the U.S. immigration process for those seeking to become permanent residents through investment in a new commercial enterprise. The form must be filled out and submitted to the United States Citizenship and Immigration Services (USCIS) in order to apply for immigrant status.

The I-526 form can be found on the USCIS website at www.uscis.gov/forms. It is available as either a downloadable PDF or an online fillable form that can be completed directly on the website before printing and submitting it with all required documents and fees included. Additionally, copies of the I-526 form may be requested from USCIS by mail or by phone if needed.

I-526 Form – Immigrant Petition by Standalone Investor

The I-526 form, also known as the Immigrant Petition by Standalone Investor, is an application required for foreigners who wish to gain permanent residence in the United States through investment. This form asks investors to provide evidence of their investment and financial resources, along with details about their background and business experience. The petitioner must also submit a detailed business plan that outlines how they plan to create jobs or invest in a commercial enterprise once they arrive in the U.S.

In order to be eligible for the I-526 visa program, prospective investors must have access to at least $1 million USD or $500 thousand USD if investing in certain rural areas and/or high unemployment areas. Additionally, they must demonstrate an ability to manage their funds effectively and have had successful prior investments when applicable.

I-526 Form Example