FINDERDOC.COM – REG 5045 – Nonresident Military (NRM) Exemption Statement – This article provides an overview of the Nonresident Military (NRM) Exemption Statement, REG 5045. The NRM exemption statement is a document issued by the California Franchise Tax Board (FTB) to exempt certain nonresident members of the military from California income taxes on their wages earned while stationed in California. It is important to understand this exemption statement and filing requirements if you are a nonresident military member stationed in California.

Download REG 5045 – Nonresident Military (NRM) Exemption Statement

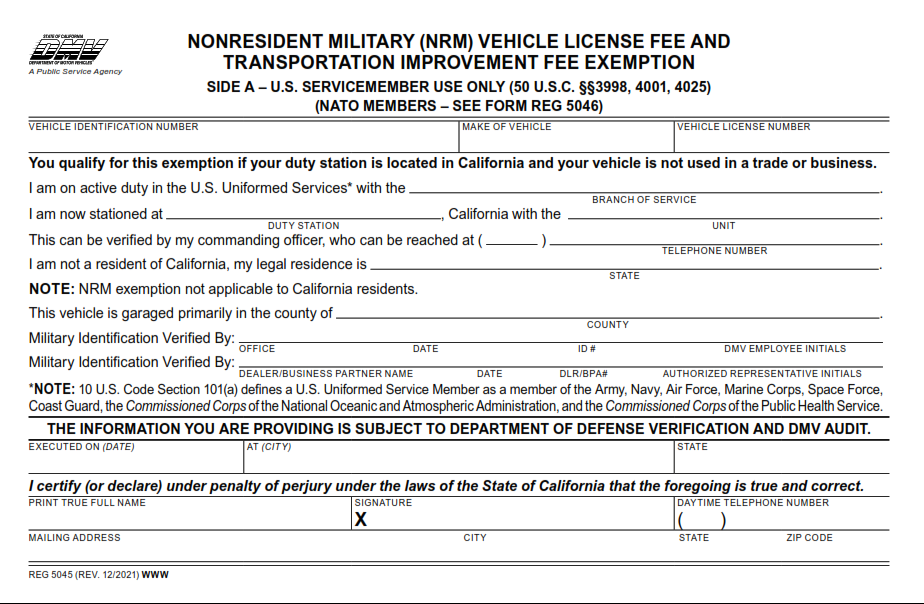

| Form Number | REG 5045 |

| Form Title | Nonresident Military (NRM) Exemption Statement |

| File Size | 290 KB |

| Form By | California DMV Form |

What is a REG 5045 Form?

REG 5045 is a form used by nonresident military personnel to claim an exemption from California income tax when their income is derived from sources in the state. This form may be required if the member of the military is stationed in California or working within the state and receives wages or other income from sources within California. The form must be completed and signed by both the servicemember and his or her spouse, if applicable.

The purpose of this form is to provide proof that a person qualifies for a nonresident military exemption, which allows them to reduce their taxable income. It includes information such as an individual’s name, address, Social Security number, dates of service in California, total amount of wages/income received while serving in California, and any applicable deductions or credits that can be claimed on their taxes.

What is the Purpose of the REG 5045 Form?

REG 5045, also known as the Nonresident Military (NRM) Exemption Statement, is a form used by eligible military personnel to claim tax exemption from certain states. The purpose of the form is to enable nonresidents in the military who are deployed away from home and have income earned in their home state to request a waiver of taxes on that income. It also helps prevent double taxation of servicemembers’ wages due to their residence status.

The information provided in REG 5045 will help states determine if an individual qualifies for an exemption based upon their service-related duties and residency status. To be eligible for this exemption, individuals must provide proof of active duty or temporary duty orders issued by the Department of Defense or other approved agencies which identify them as being stationed or on assignment away from home.

Where Can I Find a REG 5045 Form?

Individuals who need to file a REG 5045 form for the Nonresident Military (NRM) Exemption Statement can find the document online on the California Department of Tax and Fee Administration website. The form is available in both English and Spanish, so individuals can choose which language fits their needs best. The form must be completed and then submitted by mail or fax directly to the California Department of Tax and Fee Administration at the address listed on the form.

In addition to downloading the REG 5045 from the California Department of Tax and Fee Administration website, individuals may also request a copy via phone by calling 800-400-7115 or emailing [email protected] . All requests should include their contact information including name, mailing address, phone number, email address and any additional information relevant to their request.

REG 5045 – Nonresident Military (NRM) Exemption Statement

The Nonresident Military (NRM) Exemption Statement, also known as REG 5045, is a California Department of Motor Vehicles form that allows active duty military personnel and their dependents to be exempt from paying certain taxes and fees when registering a vehicle. The exemption applies only to service members who are not residents of the state of California.

Under REG 5045, active duty military personnel may be exempt from paying California Vehicle License Fee (VLF), Vehicle Registration Fee (VRF), Registration Penalty Fees, and Transportation Improvement Fees (TIF). Furthermore, the exemption can also include any county or district taxes that would otherwise apply to non-residents. When claiming the NRM exemption under REG 5045, an individual must provide proof of active military status such as a Leave and Earnings Statement or another official government document.

REG 5045 Form Example