FINDERDOC.COM – REG 5085 – Notification of Alternative Forms of Financial Responsibility – Welcome to REG 5085 – Notification of Alternative Forms of Financial Responsibility. This article provides a comprehensive overview of the different forms of financial responsibility that are available for individuals, businesses and other entities. It looks at the reasons why alternative forms of financial responsibility might be used, what is required to use them, and how they can benefit those who choose to take advantage of them. The article will also consider various scenarios in which alternative forms of financial responsibility might be beneficial, as well as any potential drawbacks that may arise from using these alternative forms.

Download REG 5085 – Notification of Alternative Forms of Financial Responsibility

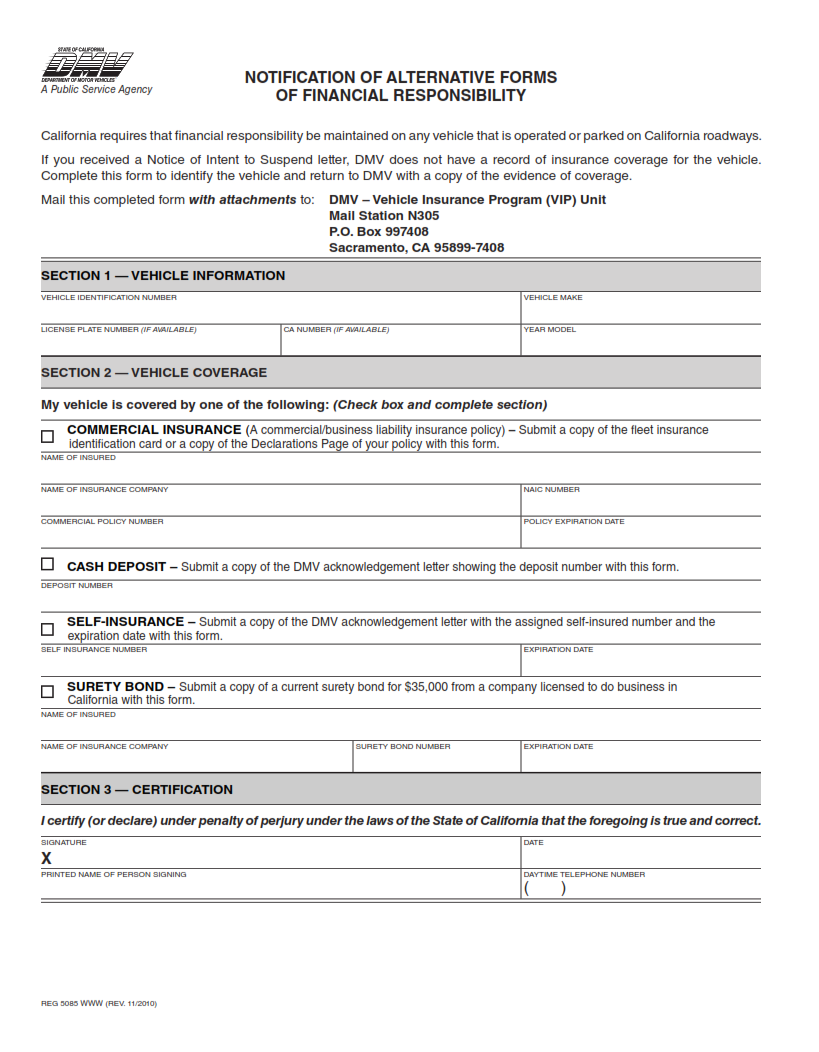

| Form Number | REG 5085 |

| Form Title | Notification of Alternative Forms of Financial Responsibility |

| File Size | 80 KB |

| Form By | California DMV Form |

What is a REG 5085 Form?

REG 5085 is an important form issued by the California Department of Motor Vehicles (DMV). It serves as a notification that the registered owner of a vehicle has provided alternative forms of financial responsibility for their vehicle. This form must be completed when someone other than the registered owner is responsible for paying damages resulting from an accident involving the vehicle.

In order to complete this form, all parties involved in the accident must provide information such as name, address, driver’s license number, and insurance policy details. The DMV will also require proof of financial responsibility from each party before processing REG 5085. Once all documentation is submitted to the DMV, they will review and approve or deny this request based on criteria such as whether or not it meets state requirements.

What is the Purpose of the REG 5085 Form?

REG 5085 is a form issued by the California Department of Motor Vehicles (DMV) that allows individuals to notify the DMV of an alternative means of financial responsibility. The primary purpose of this document is to ensure that all vehicle owners have the necessary insurance coverage or other forms of financial responsibility in order to legally operate a motor vehicle in California. By filing REG 5085, drivers can provide proof that they will be able to pay for any damages caused as a result of their driving.

This form must be completed and submitted by individuals who are not able to purchase traditional liability insurance due to certain factors such as an inability to meet eligibility requirements or high premiums. Examples of acceptable alternatives include self-insurance, bonds, certificates, or cash deposits with the DMV.

Where Can I Find a REG 5085 Form?

The REG 5085 is an important document for those who are required to demonstrate financial responsibility under California law. This form provides proof of insurance, and it is required when registering or renewing a vehicle registration in the state.

In order to obtain a REG 5085 form, you must contact your local DMV office or visit their website. The DMV will provide you with the form and instructions on how to complete it. Additionally, many auto insurers also provide copies of the forms that can be completed online or printed out and mailed in along with other paperwork related to your insurance policy. It is important to keep in mind that not all insurers offer this option, so it is best to check with your provider before attempting to obtain a REG 5085 form from another source.

REG 5085 – Notification of Alternative Forms of Financial Responsibility

REG 5085 is a notification of alternative forms of financial responsibility that was passed by the Federal Motor Carrier Safety Administration (FMCSA) in order to provide additional protection for commercial motor carriers and their drivers. This regulation provides an option for motor carriers to self-insure their fleets instead of purchasing the required insurance from a third-party provider.

The main purpose of this regulation is to ensure that all employers are financially responsible for any damages that arise from an accident involving one or more vehicles owned or operated by them. In turn, this will also provide protection for the public, as well as other drivers on the road, in case of an incident. The FMCSA has established specific requirements that must be met before a company can apply and qualify for self-insurance status.

REG 5085 Form Example