FINDERDOC.COM – DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA) – DAF Form 2451, also known as the Financial Statement for Remission of Indebtedness (LRA), is a significant document that plays a crucial role in relieving taxpayers of their financial obligations to the Internal Revenue Service (IRS). The LRA program provides relief to taxpayers who are unable to pay off their tax debts due to financial hardship or other extenuating circumstances.

Download DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA)

| Form Number | DAF Form 2451 |

| Form Title | Financial Statement – Remission Of Indebtedness (LRA) |

| File Size | 1 MB |

| Date | 13 -12- 2022 |

What is a DAF Form 2451?

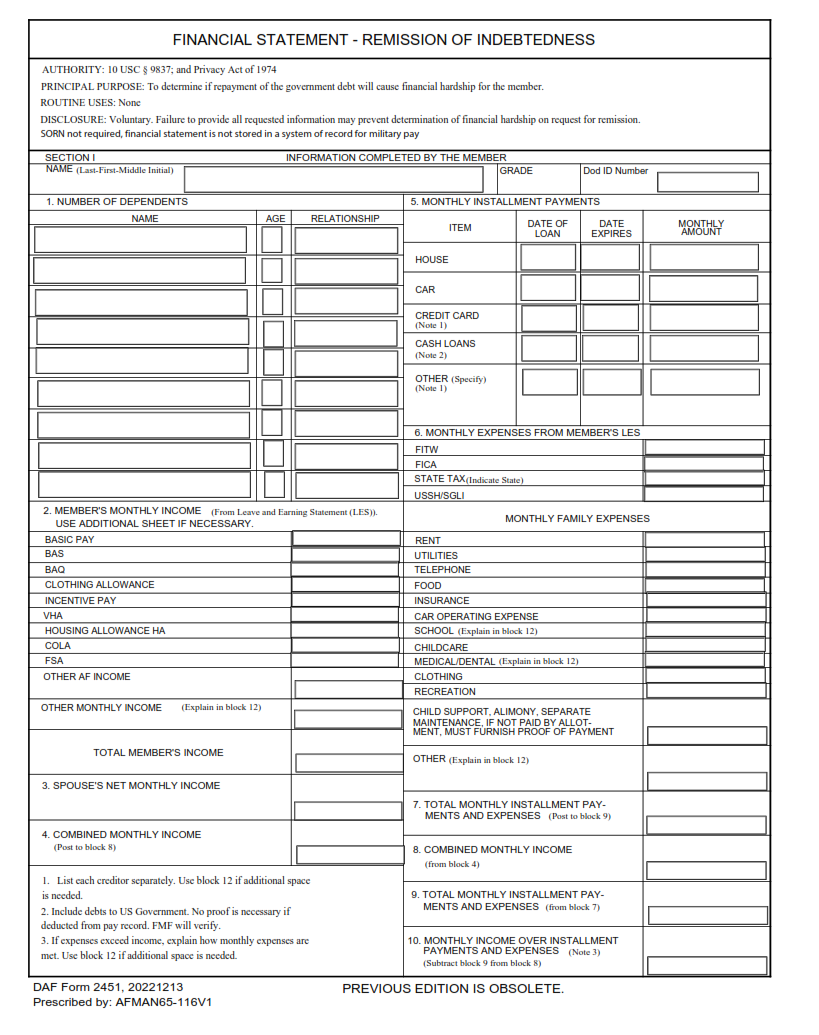

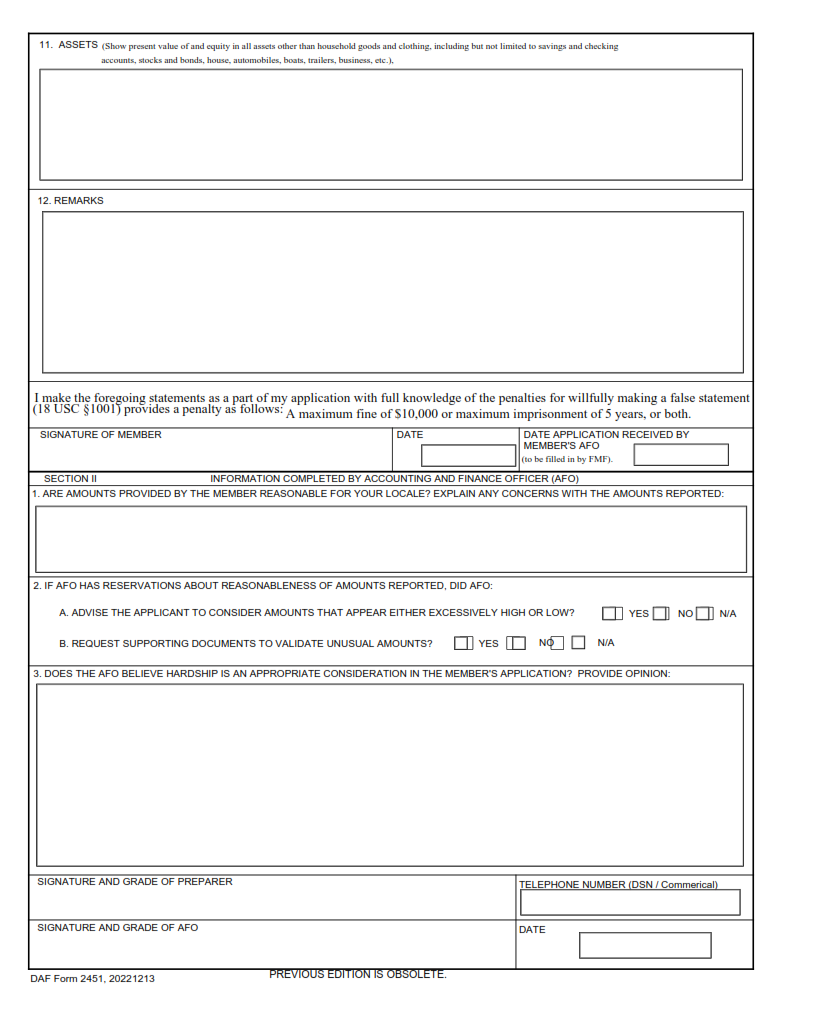

DAF Form 2451 is a financial statement that is used to request the remission of indebtedness in accordance with the Legal Relief Act (LRA). The form includes detailed information about the debtor’s financial situation and their ability to pay off their debts. It requires documentation such as bank statements, tax returns, and proof of income.

The purpose of this form is to help individuals who are struggling with overwhelming debt. By submitting this form, they can request relief from their creditors and have a chance to get back on track financially. However, it should be noted that not all debts are eligible for remission under the LRA, and each case is evaluated on an individual basis.

If you are considering submitting a DAF Form 2451, it is important to consult with a qualified legal professional who can guide you through the process. They can help you determine whether or not you qualify for debt relief and provide advice on how best to proceed. With careful planning and expert guidance, it may be possible to achieve financial freedom through remission of indebtedness under the LRA.

What is the Purpose of DAF Form 2451?

DAF Form 2451 is a financial statement that serves the purpose of remission of indebtedness under the LRA. The form is designed to gather information about an individual’s financial situation, including their assets, liabilities, income and expenses. It requires individuals to provide detailed information about their income from all sources, such as salary and wages, investments and rental properties.

The purpose of DAF Form 2451 is to assess an individual’s ability to repay any outstanding debts owed to the government or other creditors. This helps ensure that only those who are truly unable to pay are granted debt relief through the remission process. The form also helps determine the appropriate amount of remission that should be granted based on an individual’s financial circumstances.

Overall, DAF Form 2451 plays a crucial role in facilitating the process of debt remission under the LRA by providing accurate and comprehensive information about an individual’s finances. It ensures that debt relief is provided only where it is necessary and appropriate while maintaining accountability for public funds.

Where Can I Find a DAF Form 2451?

DAF Form 2451 is a financial statement used to apply for the remission of indebtedness under the LRA (Loan Repayment Assistance) program. This program allows borrowers who are experiencing financial hardship to have their student loan debt forgiven or canceled. The form can be found on the official website of the Department of Defense, along with other necessary documents and instructions.

In addition to the DAF Form 2451, applicants will need to provide documentation of their income, assets, and expenses. This information is used to determine whether they qualify for loan forgiveness under the LRA program. It is important for borrowers to carefully review all requirements and deadlines before submitting their application.

If you are unable to find or access the DAF Form 2451 online, you may contact your loan servicer or a representative from the Department of Defense for assistance. They can provide you with further guidance on how to obtain and submit your application for loan forgiveness through the LRA program.

DAF Form 2451 – Financial Statement – Remission Of Indebtedness (LRA)

DAF Form 2451 is a financial statement used to file for remission of indebtedness under the Longshore and Harbor Workers’ Compensation Act (LHWCA). This form is specifically for claimants seeking relief from debt owed to the federal government due to overpayment or other errors related to LHWCA benefits. The purpose of Form 2451 is to provide detailed information about the claimant’s current financial situation, including income, expenses, assets, and liabilities.

To qualify for remission of indebtedness under LRA, claimants must demonstrate that they are unable to repay the debt without causing undue hardship. This requires submitting a comprehensive financial statement using DAF Form 2451. The information provided on this form helps the government determine whether the claimant meets the criteria for remission and how much relief they may receive.

Overall, DAF Form 2451 plays a crucial role in helping workers who have received LHWCA benefits but are struggling with debt. By providing detailed financial information through this form, these workers can seek remission of their debt while still receiving necessary support through LRA programs.

DAF Form 2451 Example