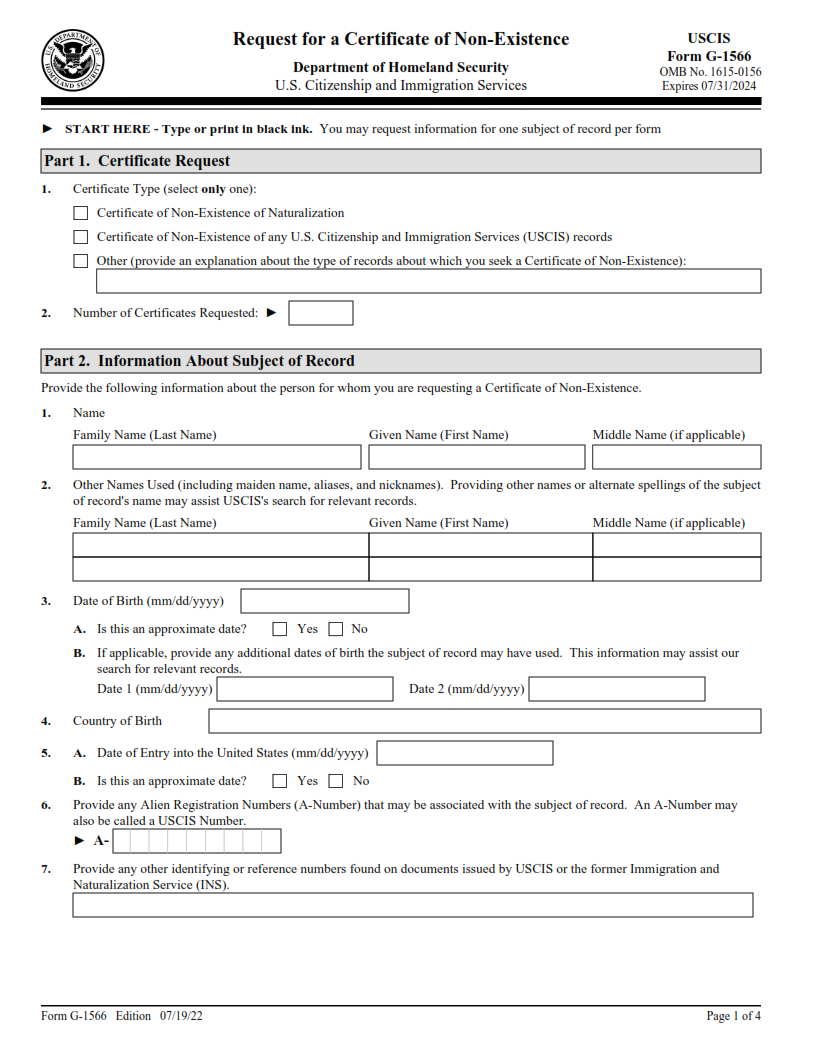

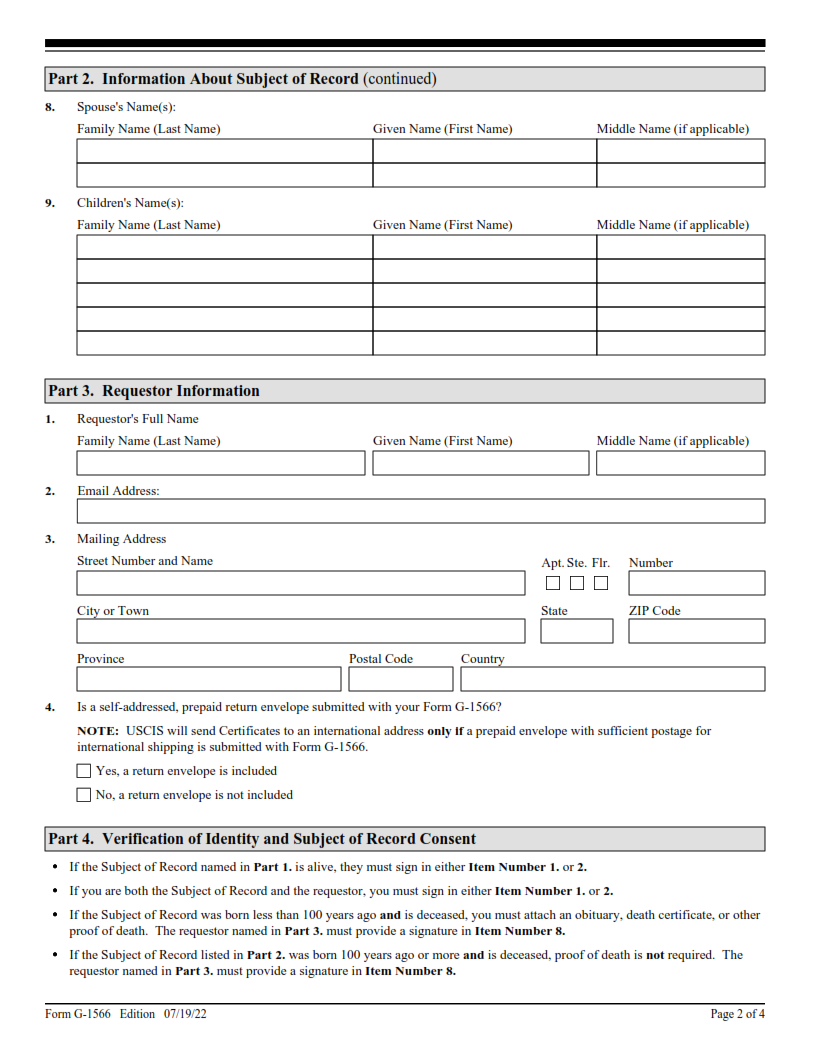

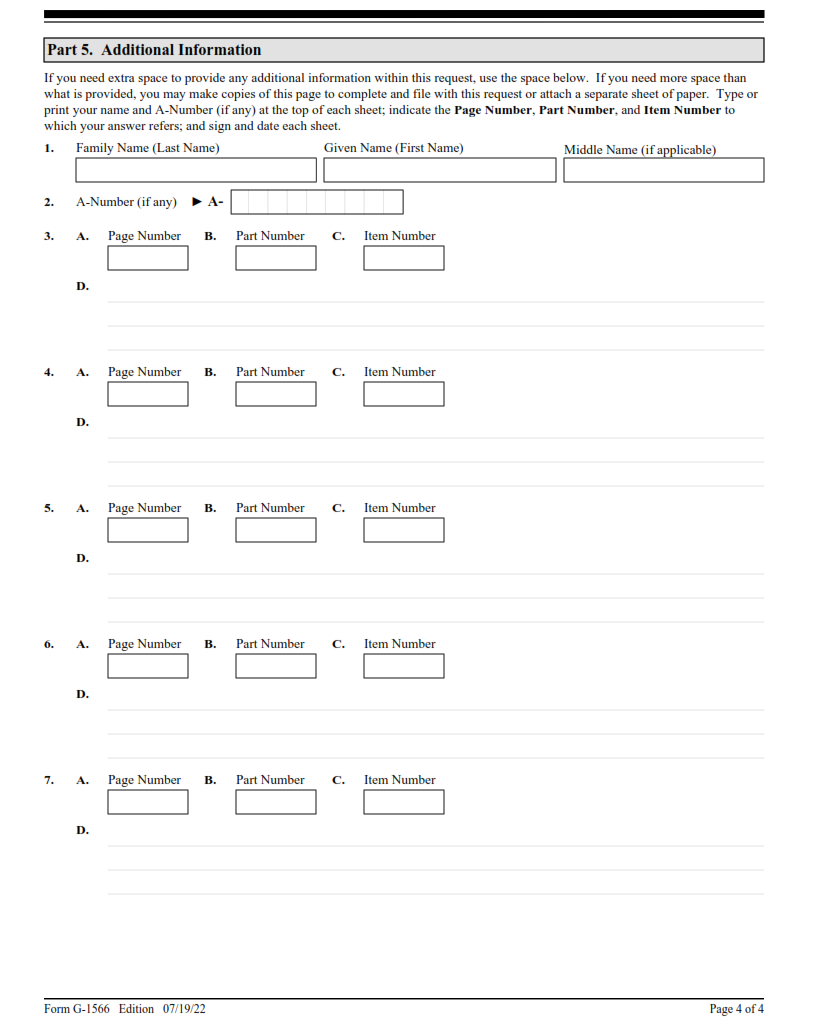

FINDERDOC.COM – G-1566 Form – Request for Certificate of Non-Existence – The G-1566 form is an important document used to prove the non-existence of a business or organization. It can be beneficial in a number of situations where the existence or nonexistence of something needs to be verified, such as when applying for certain permits or registering a trademark. For example, if you want to register your business with the Secretary of State, you may need to file this form. This article will provide comprehensive information about the G-1566 Form and instructions on how to properly complete it.

Download G-1566 Form – Request for Certificate of Non-Existence

| Form Number | G-1566 Form |

| Form Title | Request for Certificate of Non-Existence |

| File Size | 343 KB |

| Form By | USCIS Forms |

What is a G-1566 Form?

A G-1566 form is a document typically used by an individual or business to request a Certificate of Non-Existence from the Internal Revenue Service (IRS). This certificate is provided to prove that no taxes are due on certain assets, such as those associated with a trust or estate. The form is specific to the estate or trust and must be filled out accurately in order for the IRS to issue the certificate.

The G-1566 form requires information about the applicant, including name, address and contact information. It also requires details about the trust or estate, including date of creation and its purpose. Additionally, applicants must provide proof that all required filings have been made with the IRS prior to requesting a Certificate of Non-Existence. Once completed, the form can be sent directly to an IRS field office by mail or fax.

What is the Purpose of the G-1566 Form?

The G-1566 Form is an important document used to request a Certificate of Non-Existence from the Internal Revenue Service (IRS). This certificate verifies that a taxpayer does not owe any taxes or penalties to the IRS. The form can be used by businesses and individuals alike, as it is an essential part of the tax process for those who want to prove their financial compliance with federal law.

In order to receive a Certificate of Non-Existence, taxpayers must submit their completed G-1566 Form along with all required supporting documentation. This includes copies of income tax filings for the past three years, as well as proof of payment on any outstanding taxes or penalties owed. Once submitted, the IRS will review all documents and issue a letter confirming that no unpaid taxes or penalties exist for the taxpayer in question.

Where Can I Find a G-1566 Form?

The G-1566 Form is an official document that must be completed in order to receive a Certificate of Non-Existence from the State of Delaware. The form must be submitted along with the necessary application fee and other documents as required. It is important to note that the G-1566 Form must be obtained from the State of Delaware’s Secretary of State website or office, as it cannot be found or downloaded on any other sites.

The G-1566 form can also be requested by mail, with specific instructions given on the website for those who choose this option. It should take approximately 3-5 business days before you will receive your form in the mail if requested this way. Once received, simply fill out all sections completely and accurately and return it to their office using one of their accepted delivery methods, such as registered mail or certified mail with return receipt requested.

G-1566 Form – Request for Certificate of Non-Existence

The G-1566 Form is an essential document for businesses in the state of California. This form, also known as the Request for Certificate of Non-Existence, must be submitted to the Secretary of State’s office when a business wishes to dissolve or surrender their rights and privileges as a corporation or LLC. The form requests information on the company such as its name, address, and corporate officer details. Once completed and submitted along with any necessary documents or fees, the Secretary of State will issue a Certificate of Non-Existence confirming that the particular business entity has officially been dissolved.

In order to complete this form accurately, it is important to understand what type of business entity needs to be dissolved and make sure all data entered is accurate. Additionally, there may be other forms required depending on what type of business entity needs dissolution.

G-1566 Form Example