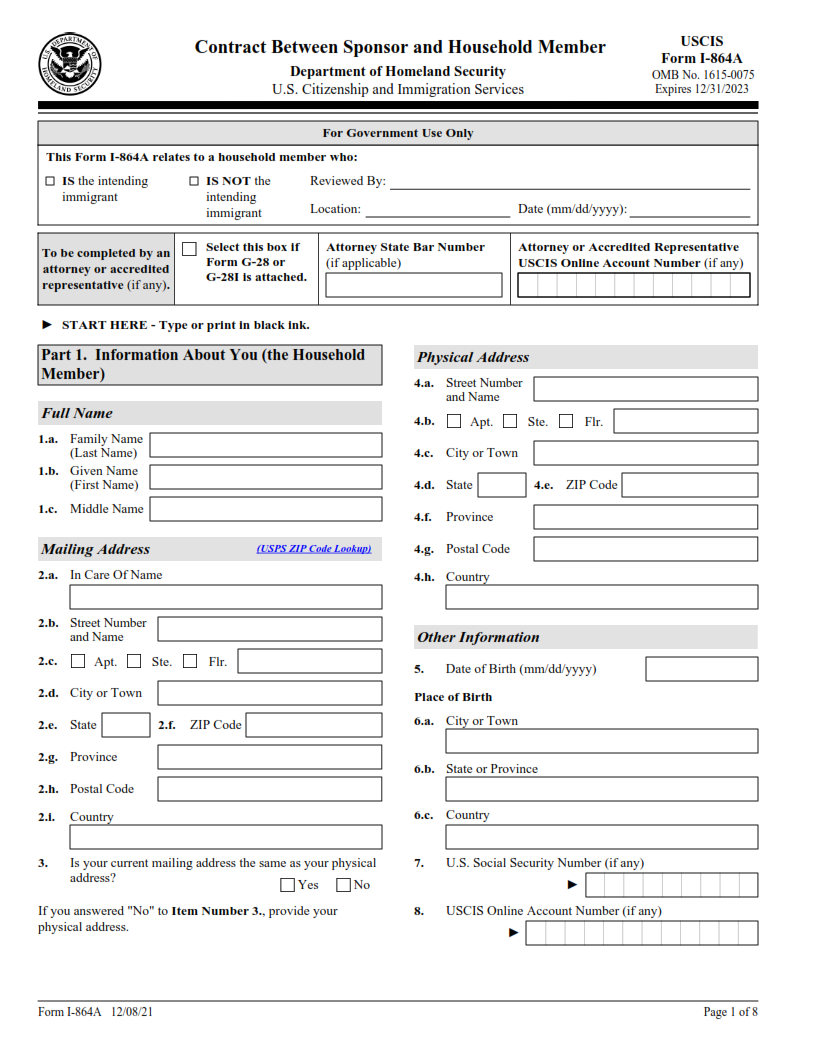

FINDERDOC.COM – I-864A Form – Contract Between Sponsor and Household Member – The I-864A Form is an important document for any US citizen or permanent resident who sponsors a foreign national to live in the United States. This form, also known as the “Contract Between Sponsor and Household Member”, serves as a contract between the sponsor and the sponsored individual and outlines their responsibilities to each other. It is often used in conjunction with Form I-864, Affidavit of Support, which must be completed by all sponsors of immigrants applying for legal status in the United States.

Download I-864A Form – Contract Between Sponsor and Household Member

| Form Number | I-864A Form |

| Form Title | Contract Between Sponsor and Household Member |

| File Size | 467 KB |

| Form By | USCIS Forms |

What is an I-864A Form?

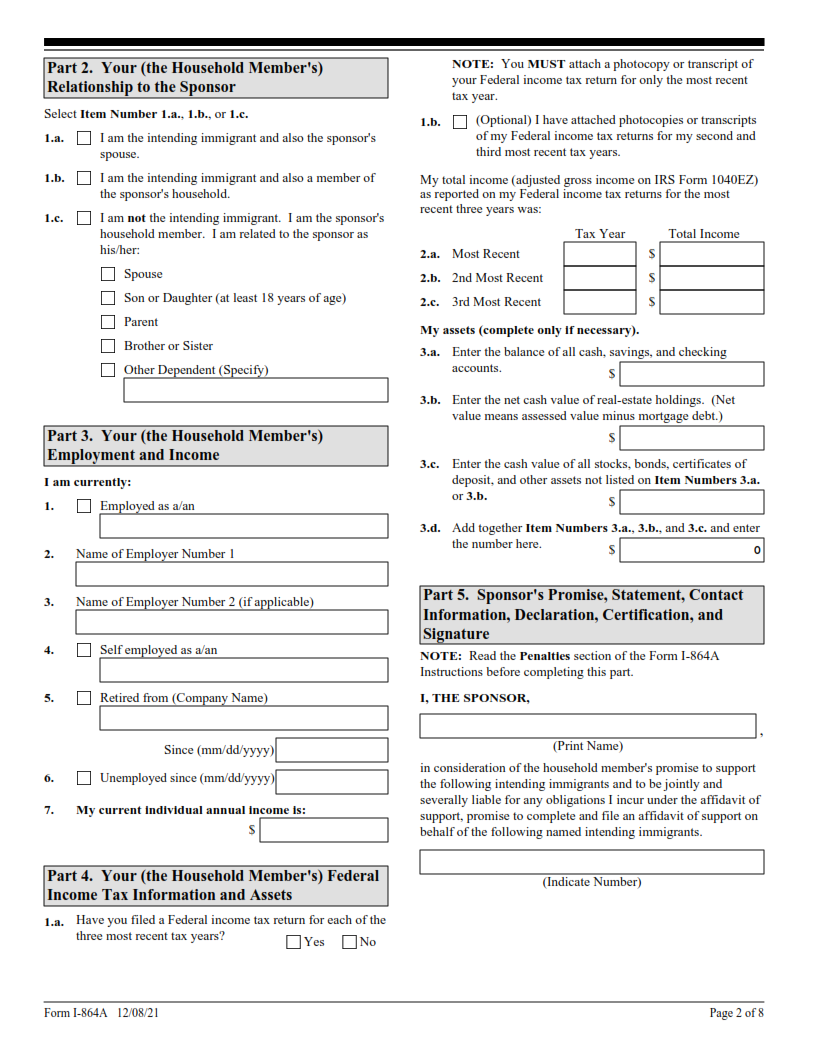

The I-864A form is a contract between the sponsor and certain household members of an immigrant filing for a green card. This document plays an important role in demonstrating to the United States Citizenship and Immigration Services (USCIS) that the applicant will not become a public charge, meaning they won’t be dependent on public benefits for their support. It also allows for any income or assets of certain household members to be taken into consideration when determining if the applicant has sufficient financial resources to obtain permanent residency.

The I-864A form must include information about all adult household family members who are providing financial sponsorship of the immigrant, such as their name, address, relationship to the applicant, citizenship/residency status, and financial information including income and assets.

What is the Purpose of the I-864A Form?

The I-864A Form, also known as the Contract Between Sponsor and Household Member, is an important document in the process of sponsoring a family member for a green card. It is used to verify that the sponsor’s financial resources will be shared with any sponsored family members living in their household.

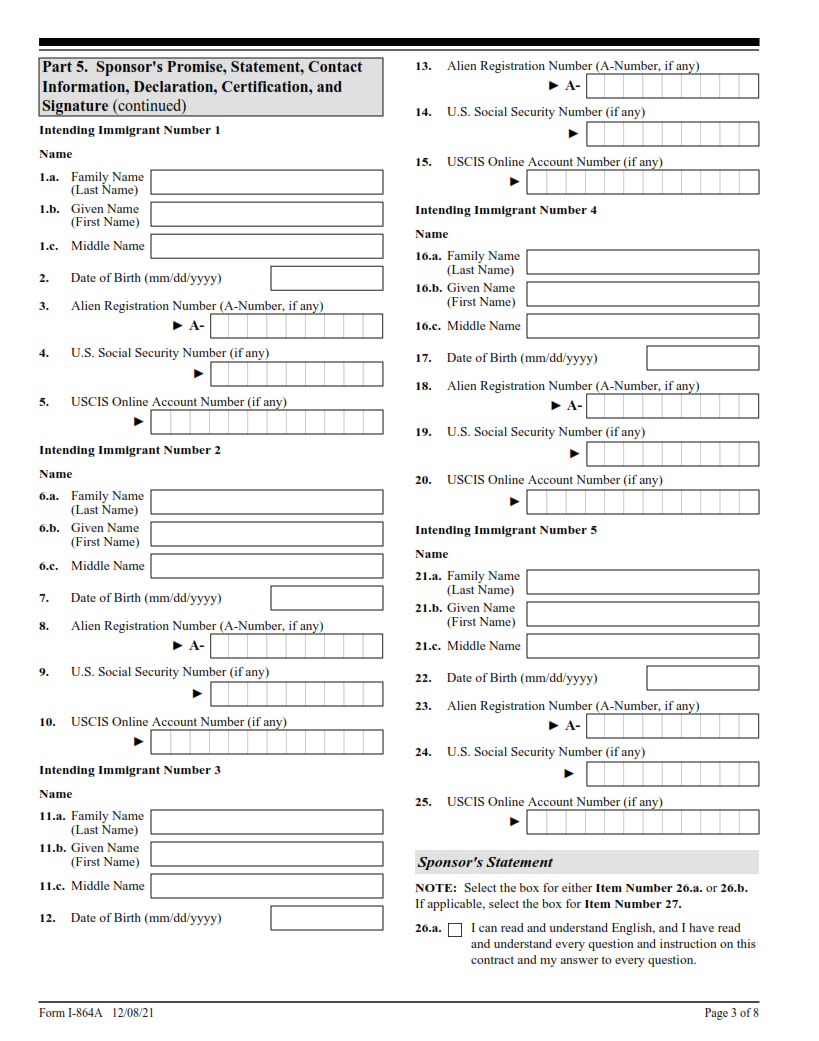

The form requires sponsors to state that they accept responsibility for providing financial support to a sponsored family member if they are unable to do so themselves. The sponsor must provide evidence of their financial resources, such as income and assets, and agree to use them towards supporting the sponsored family member if needed. All household members who are included on the form must sign it in order for it to be valid.

In addition, sponsors must agree not to receive any additional benefits from welfare programs on behalf of the sponsored family member until they become citizens or permanent residents.

Where Can I Find an I-864A Form?

The I-864A form is an important document for those who are sponsoring a foreign national for a green card. It is available from the U.S. Citizenship and Immigration Services (USCIS) in both English and Spanish versions, as well as from various other sources online.

Those who wish to access the I-864A form can do so by visiting the USCIS website, where it can be downloaded in either PDF or Word formats. Additionally, those seeking to print out a paper copy of the form can obtain one via mail by calling 1-800-870-3676 or requesting one through the USCIS Contact Center services on their website. For those needing further assistance with completing and submitting this document, they may contact an accredited representative or qualified immigration attorney.

I-864A Form – Contract Between Sponsor and Household Member

The I-864A Form is an important document in the immigration process. It is a contract between the sponsor of an individual and any household members who are immigrating to the United States with them. This form is used when two or more people are filing for immigrant visas together, such as a husband and wife, or parent and child.

The I-864A Form states that all household members are legally responsible for supporting each other financially once they arrive in the United States. It also outlines the sponsor’s responsibility for providing financial support to their dependents if needed. The form includes information about who will be responsible for health insurance costs and any taxes due by family members when they become U.S. citizens or permanent residents.

I-864A Form Example