FINDERDOC.COM – REG 101 – Statement to Record Ownership – REG 101 is an important course for those looking to understand how to properly record ownership. It covers all the necessary steps and paperwork associated with documenting an asset. This article will provide a comprehensive overview of what you need to know about registering property, the different types of registration, and the critical differences between each one. From understanding titles and deeds, easements, leases, liens, encumbrances, and more—it’s all covered in this crash course on REG 101.

Download REG 101 – Statement to Record Ownership

| Form Number | REG 101 |

| Form Title | Statement to Record Ownership |

| File Size | 76 KB |

| Form By | California DMV Form |

What is a REG 101 Form?

REG 101 is a statement used to record ownership of securities in the United States. It is also known as the “Statement of Beneficial Ownership” and must be filed by those who own more than 5% of a company’s equity or debt securities. The statement must be filed with the Securities and Exchange Commission (SEC) for any company which has registered its securities with the SEC under Section 12, 13 or 15(d) of the 1934 Securities Exchange Act.

The REG 101 form requires information about the beneficial owner such as their name, address, date of birth and Social Security Number. Additionally, it requires details about the security that they hold such as the class and quantity owned, when it was acquired and how it was acquired.

What is the Purpose of REG 101 Form?

The REG 101 Form is a document used by businesses to register securities with the Securities and Exchange Commission (SEC). The purpose of this form is to record ownership of a company’s issued securities and provide information on the company’s financial condition. This form must be filed when issuing new securities or registering previously-issued securities with the SEC.

REG 101 also helps protect investors by ensuring that companies provide accurate information about their financial condition. Companies must complete the form thoroughly and accurately, including details such as the offering price, type of security being offered, total number of shares outstanding, and any restrictions on trading in the securities. Additionally, companies may need to include other supporting documents such as prospectuses and financial statements. By filing this form with the SEC, companies are helping to ensure that potential investors have access to reliable information about their business operations before investing in their securities.

Where Can I Find a REG 101 Form?

The REG 101 form is a Statement to Record Ownership that must be filed with the California Department of Business Oversight. This document is used to change the ownership status of a business, such as adding or removing owners or shareholders. The easiest way to find and obtain the REG 101 form is through the California Department of Business Oversight website.

The REG 101 form can be found under “Forms” on their website, in the “Corporations” section, labeled “REG-101 Statement to Record Ownership.” The form can be downloaded and printed out for easy completion. It should be noted that accurate information must be provided in order for the form to be processed correctly and efficiently by the department. Additionally, filing fees may apply when submitting this type of documentation.

REG 101 – Statement to Record Ownership

REG 101 is a statement that record owners can use as evidence of their ownership. It allows them to transfer ownership rights without having to physically transfer the records themselves. The document serves as proof of ownership, and can be used in court if necessary.

The statement must be signed and dated by both parties involved in the transfer. It should include all pertinent information such as the owner’s name, address, phone number, and any other relevant details. Additionally, it should detail exactly what rights are being transferred with this particular transaction. This helps ensure that both parties know what they are agreeing to and that there is no misunderstanding about who owns what when the transaction is complete.

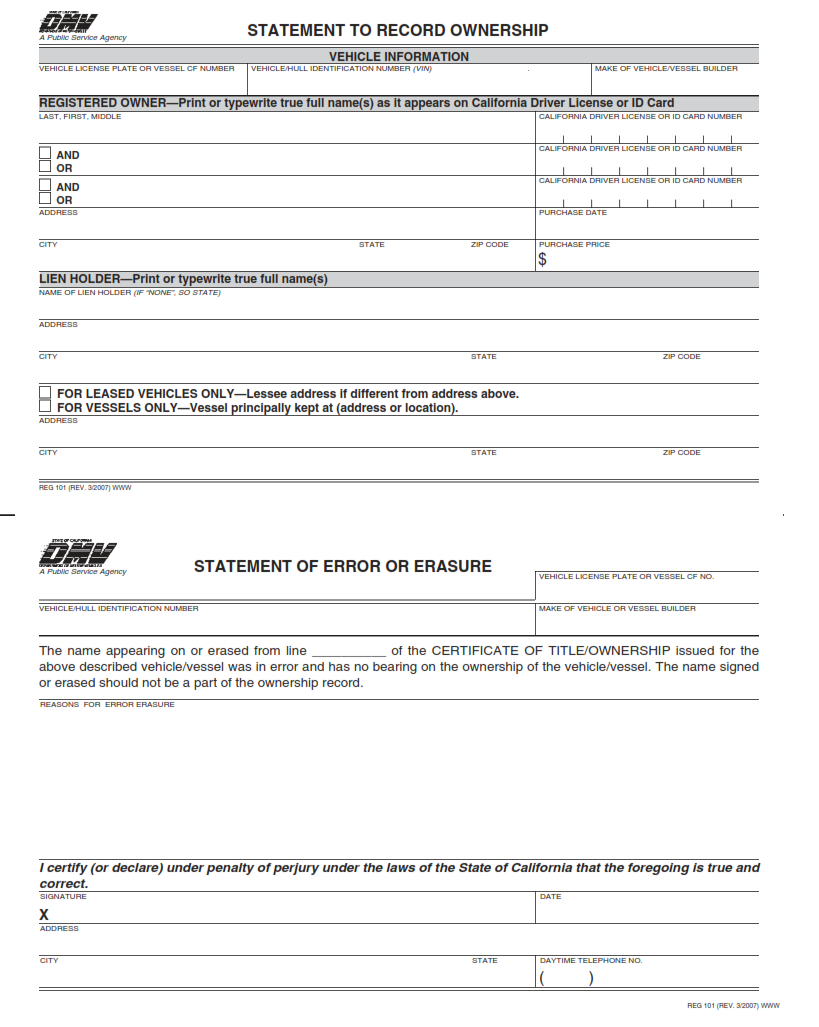

REG 101 Form Example