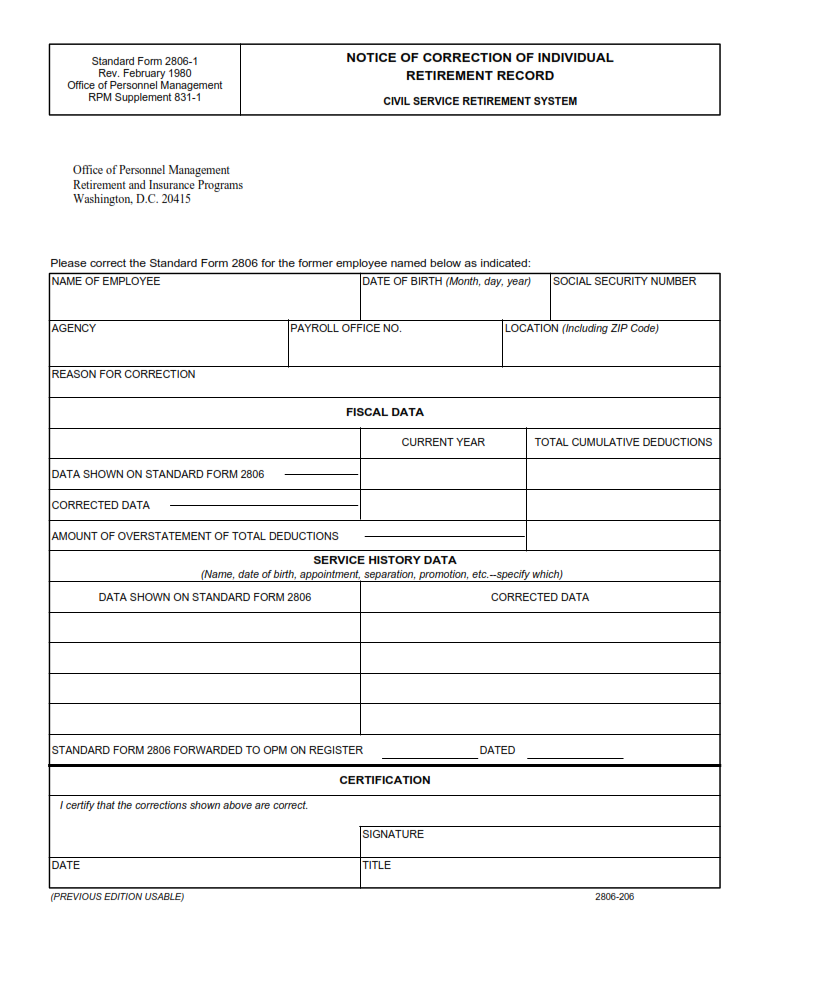

FINDERDOC.COM – SF Form 2806-1 – Notice of Correction of Individual Retirement Record, Civil Service Retirement System – The SF Form 2806-1, also known as the Notice of Correction of Individual Retirement Record, is a crucial document for individuals enrolled in the Civil Service Retirement System (CSRS). This form allows federal employees to correct errors or omissions in their retirement records, ensuring that they receive accurate benefits when they retire.

Download SF Form 2806-1 – Notice of Correction of Individual Retirement Record, Civil Service Retirement System

| Form Number | SF Form 2806-1 |

| Form Title | Notice of Correction of Individual Retirement Record, Civil Service Retirement System |

| File Size | 305 KB |

| Date | 07 -06- 2007 |

What is a SF Form 2806-1?

The SF Form 2806-1 is a notice of correction form used by employees under the Civil Service Retirement System (CSRS) to correct their individual retirement record. The CSRS is a retirement plan for federal employees who were hired before January 1, 1984. This form is important because it ensures that an employee’s retirement benefits are accurate and up-to-date.

The SF Form 2806-1 is typically used when there are errors or omissions in an employee’s retirement record. For example, an employee may need to correct their service credit, survivor benefit election, or beneficiary designation. Once the form has been completed and submitted to the appropriate agency, the corrections will be made to the individual’s retirement record.

It is essential for Civil Service Retirement System employees to keep their records updated as this affects their eligibility for benefits upon retirement. Filling out an SF Form 2806-1 helps ensure that an individual’s records are accurately reflected in the system so that they can receive all of their entitled benefits after they retire from service.

What is the Purpose of SF Form 2806-1?

The SF Form 2806-1 is a document used by federal employees who participate in the Civil Service Retirement System (CSRS). The purpose of this form is to correct errors or omissions in an employee’s individual retirement record. This includes correcting information such as name, date of birth, and service credit.

The accuracy of an employee’s retirement record is crucial because it determines their eligibility for benefits and the amount of those benefits. For example, if an employee’s service credit is incorrect, they may not be able to retire at their desired time or receive the full amount of their expected retirement benefits.

In order to ensure that an employee’s retirement record is accurate and up-to-date, it is important that any errors or omissions are corrected as soon as possible. The SF Form 2806-1 provides a straightforward process for federal employees to request corrections and updates to their individual retirement records within the CSRS.

Where Can I Find a SF Form 2806-1?

If you are a federal employee under the Civil Service Retirement System (CSRS), you may need to fill out an SF Form 2806-1 if there are corrections that need to be made to your individual retirement record. This form is used to ensure that your retirement benefits are accurate and up-to-date.

To obtain an SF Form 2806-1, you can visit the Office of Personnel Management (OPM) website or contact your agency’s human resources department. You can also request a copy of the form by mail, phone, or fax through OPM’s Retirement Information Center.

Once you have obtained the form, be sure to fill it out completely and accurately. Any errors in the information provided could delay the processing of your retirement benefits. After completing the form, submit it along with any supporting documentation to your agency’s human resources department for review and processing.

SF Form 2806-1 – Notice of Correction of Individual Retirement Record, Civil Service Retirement System

SF Form 2806-1 is an important document used to make corrections to an individual’s retirement record under the Civil Service Retirement System. This form is typically used when there are errors or discrepancies in a person’s retirement record, such as missing service credit or inaccurate salary information. By completing and submitting this form, individuals can ensure that their retirement benefits are accurate and up-to-date.

It’s important to note that SF Form 2806-1 should only be used for corrections related to the Civil Service Retirement System. Those who have additional retirement plans through other sources, such as Social Security or a private pension plan, will need to follow different procedures for correcting their records. Additionally, it’s essential to submit this form in a timely manner to avoid any delays in receiving retirement benefits. Overall, SF Form 2806-1 is an essential tool for ensuring that federal employees receive the correct pension benefits they are entitled to under the Civil Service Retirement System.

SF Form 2806-1 Example